10 TOP TELEHEALTH SOLUTIONS ELEVATING PRIMARY CARE PROVIDERS' PRACTICES Discover the top telehealth solutions that are transforming the way primary care providers deliver healthcare services to patients, enhancing accessibility, and improving outcomes. In recent years, telehealth has emerged as a key component in the healthcare sector, providing primary care providers with innovative and efficient ways to connect with patients. Telehealth solutions for primary care providers have significantly improved the delivery of care, enabling better access and convenience for both practitioners and their patients. In this blog post, we'll explore 10 top telehealth solutions that are redefining primary care services. Amwell One of the leading telehealth solutions for primary care providers, Amwell offers a comprehensive platform for delivering care remotely. With a robust suite of tools, Amwell enables virtual consultations, remote patient monitoring, and seamless integration with electronic health records (EHR). Teladoc Teladoc is a popular telehealth solution for primary care providers who are looking to offer patients on-demand access to healthcare services. With a user-friendly app and an extensive network of healthcare professionals, Teladoc makes it easy for patients to connect with primary care providers from the comfort of their own homes. MDLive Another well-known telehealth solution for primary care providers is MDLive, a platform that offers virtual visits, e-prescriptions, and behavioral health services. MDLive helps primary care providers expand their reach, offering care to patients in remote locations or those with mobility challenges. Doctor on Demand Doctor on Demand is a telehealth solution for primary care providers that focuses on delivering high-quality, video-based consultations. The platform also offers additional services such as preventive care, chronic care management, and mental health support. SnapMD SnapMD is a telehealth solution for primary care providers that offers a secure, cloud-based platform for virtual consultations. With its user-friendly interface and comprehensive features, SnapMD enables primary care providers to deliver personalized care to patients remotely. eVisit eVisit is a telehealth solution for primary care providers that focuses on simplicity and efficiency. The platform offers an easy-to-use interface for both providers and patients, enabling secure video consultations and seamless integration with EHR systems. GlobalMed GlobalMed is a telehealth solution for primary care providers that offers a wide range of services, including virtual consultations, remote patient monitoring, and telestroke care. With its focus on innovation, GlobalMed helps primary care providers improve patient outcomes and reduce healthcare costs. PlushCare PlushCare is a telehealth solution for primary care providers that offers a wide range of services, including virtual consultations, prescription management, and lab test coordination. The platform also focuses on preventive care and chronic condition management, helping primary care providers to deliver comprehensive care remotely. Chiron Health Chiron Health is a telehealth solution for primary care providers that offers a secure, cloud-based platform for virtual consultations. The platform integrates with existing EHR systems and offers features such as appointment scheduling and billing, making it an attractive option for primary care providers looking to expand their telehealth services. Spruce Health Spruce Health is a telehealth solution for primary care providers that offers secure messaging, video consultations, and care coordination tools. The platform is designed to help primary care providers streamline their workflows and improve patient engagement. These top telehealth solutions for primary care providers are transforming the way healthcare services are delivered, making it easier for practitioners to reach patients and offer high-quality care. As the healthcare landscape continues to evolve, embracing telehealth solutions will become increasingly vital for primary care providers looking to stay competitive and deliver exceptional patient experiences.

0 Comments

A Comprehensive Guide on How to Appeal a Medical Prior Authorization Denial for Medical Providers5/9/2023 A Comprehensive Guide on How to Appeal a Medical Prior Authorization Denial for Medical Providers Learn how to effectively appeal a medical prior authorization denial as a medical provider with this comprehensive guide. Discover helpful tips and strategies to increase your chances of success. GoHealthcare Practice Solutions can also assist you in navigating the process. As a medical provider, dealing with medical prior authorization denials can be frustrating and time-consuming. However, appealing these denials is a necessary process to ensure that your patients receive the care they need. In this comprehensive guide, we will discuss the steps you can take to appeal a medical prior authorization denial effectively. We will provide you with practical tips and strategies to help you navigate the process with confidence. Step 1: Understand the Reason for Denial The first step in appealing a medical prior authorization denial is to understand the reason for the denial. Review the denial letter carefully, paying attention to the specific reason(s) for the denial. This will help you to identify the specific information or documentation needed to support your appeal. Step 2: Gather Supporting Documentation Gathering all necessary supporting documentation is crucial in the appeal process. This includes medical records, test results, and any other relevant documentation that supports the medical necessity of the procedure or treatment. Make sure to also include any additional information that was not submitted with the original prior authorization request. Step 3: Prepare a Strong Appeal Letter Crafting a compelling and well-organized appeal letter is essential in appealing a medical prior authorization denial. The appeal letter should be concise and to the point, highlighting the medical necessity of the procedure or treatment and providing evidence to support your case. It should also address the specific reason(s) for the denial and explain why the denial was incorrect. Step 4: Submit the Appeal Once you have prepared your appeal letter and gathered all necessary supporting documentation, submit your appeal according to the insurer's guidelines. Make sure to follow all submission requirements, including deadlines and required forms. You may also consider submitting the appeal via certified mail or fax to ensure that it is received. Step 5: Follow Up and Be Persistent Following up on your appeal and being persistent is crucial in ensuring a positive outcome. Keep track of all communication with the insurer and follow up regularly to ensure that your appeal is being processed. Be persistent in advocating for your patient's care and do not be afraid to escalate your appeal to a higher authority if necessary. Successfully appealing a medical prior authorization denial requires persistence, attention to detail, and an understanding of the appeal process. By following the steps outlined in this guide and seeking assistance from GoHealthcare Practice Solutions, you can increase your chances of a positive outcome for your patient's care. Remember, advocating for your patient's health is always worth the effort. Top 10 Medical Practice Staffing Solutions: How to Build the Perfect Team Discover the best medical practice staffing solutions to optimize your team and improve patient care. Explore expert recommendations for your healthcare facility today. Running a successful medical practice requires a well-coordinated team of skilled professionals. With the right medical practice staffing solutions in place, you can ensure your team is equipped to provide top-notch patient care. In this comprehensive guide, we explore the top 10 medical practice staffing solutions to help you build the perfect team. Learn how to streamline your hiring process, develop an efficient workforce, and foster a positive work environment. Partner with a Healthcare Staffing Agency Healthcare staffing agencies specialize in placing qualified medical professionals in the right roles. Partnering with a reputable agency can save time and resources while ensuring you have access to a large pool of pre-screened candidates. Leverage Locum Tenens Staffing Locum tenens staffing can fill temporary gaps in your medical practice, ensuring seamless patient care. By working with locum tenens physicians and nurses, you can maintain a flexible workforce and avoid burnout among your permanent staff. Utilize Telemedicine Solutions Telemedicine allows healthcare providers to offer remote consultations, improving patient access and reducing the need for in-person visits. Integrating telemedicine into your practice can alleviate some staffing pressures and expand your reach. Prioritize Employee Retention Reducing staff turnover is essential for maintaining a stable and efficient medical practice. Offer competitive salaries, benefits packages, and ongoing professional development opportunities to keep your team engaged and committed. Embrace Task Delegation and Automation Identify tasks that can be delegated to non-medical staff or automated through technology. This allows your clinical team to focus on patient care while improving practice efficiency. Develop a Strong Company Culture Foster a positive work environment by prioritizing employee wellness, promoting open communication, and recognizing the hard work of your team. A strong company culture attracts and retains top talent. Create a Comprehensive Onboarding Process A well-designed onboarding program helps new hires feel supported and prepared for their roles. This leads to improved job satisfaction and retention rates. Optimize the Interview Process Streamline your interview process by creating a structured system to evaluate candidates. This ensures you hire the right individuals for your practice and minimizes the risk of costly hiring mistakes. Invest in Ongoing Staff Training Continuing education and professional development opportunities keep your team up to date with the latest medical advancements and best practices, ensuring your practice remains competitive. Monitor Performance Metrics and Conduct Regular Reviews Track key performance indicators (KPIs) and conduct regular performance reviews to assess your team's strengths and weaknesses. This helps identify areas for improvement and growth, ensuring your medical practice continues to thrive. Effective medical practice staffing solutions are vital for providing the highest quality patient care. By implementing these top 10 strategies, you can optimize your workforce, improve employee satisfaction, and ensure your medical practice's ongoing success. Keep in mind that the key to successful staffing lies in a combination of proactive planning, strategic partnerships, and continuous improvement. Invest in your team and watch your medical practice flourish. 10 Effective Patient Engagement Strategies to Improve Outcomes and Grow Your Medical Practice5/8/2023 10 Effective Patient Engagement Strategies to Improve Outcomes and Grow Your Medical Practice Looking for ways to engage your patients and improve outcomes? Check out these 10 proven strategies that can help you build a successful medical practice while enhancing patient satisfaction and loyalty. Patient engagement is a critical factor in healthcare today. Engaged patients are more likely to follow their treatment plans, adhere to medications, and take an active role in their healthcare decisions. They are also more likely to report higher levels of satisfaction with their care and have better health outcomes overall. For medical professionals looking to improve patient engagement, we've compiled a list of 10 effective strategies that you can implement in your practice today. These strategies have been proven to work for practices of all sizes and specialties, and can help you build a successful medical practice while improving patient outcomes and satisfaction. Use Patient Portals Patient portals are secure online platforms that allow patients to access their health records, communicate with their healthcare providers, and manage their appointments and medications. By offering a patient portal, you can empower patients to take an active role in their healthcare and stay engaged with their care outside of the office. Conduct Regular Patient Surveys Patient surveys are a valuable tool for understanding patient needs and preferences. By regularly surveying your patients, you can gather feedback on your practice and identify areas for improvement. This can help you tailor your services to meet patient needs and improve overall patient satisfaction. Offer Online Appointment Booking Offering online appointment booking can make it easier for patients to schedule appointments and improve their overall experience with your practice. By offering this convenience, you can reduce wait times and make it more convenient for patients to access your services. Use Social Media to Connect with Patients Social media can be a powerful tool for engaging with patients and building relationships with your community. By using social media platforms like Facebook and Twitter, you can share educational resources, promote your services, and connect with patients in a more personal way. Provide Educational Resources Providing educational resources, such as handouts and brochures, can help patients better understand their conditions and treatment options. This can improve patient engagement and help patients make more informed decisions about their healthcare. Personalize Patient Care Personalizing patient care can help patients feel more valued and engaged with their healthcare. By tailoring your services to meet each patient's unique needs and preferences, you can build trust and loyalty with your patients. Offer Telemedicine Services Telemedicine services, such as video visits and remote monitoring, can help patients access care more easily and improve overall patient satisfaction. By offering these services, you can make it more convenient for patients to receive care and reduce the burden of in-person visits. Use Mobile Health Apps Mobile health apps can help patients track their health and stay engaged with their care. By recommending trusted health apps to your patients, you can encourage them to take an active role in managing their health and improve their overall health outcomes. Implement Patient Engagement Programs Patient engagement programs, such as disease management programs and patient education programs, can help patients stay engaged with their care and improve their health outcomes. By offering these programs, you can provide patients with the tools and resources they need to take control of their health. Encourage Patient Feedback Encouraging patient feedback can help you identify areas for improvement and build stronger relationships with your patients. By asking for feedback and responding to patient concerns, you can show patients that you value their opinions and are committed to providing high-quality care. Patient engagement is critical for improving outcomes and building a successful medical practice. By implementing the strategies outlined above, you can engage your patients, improve their satisfaction, and ultimately enhance their health outcomes. Remember, patient engagement is an ongoing process, and it requires a commitment to continuous improvement and a patient-centered approach to care. References:

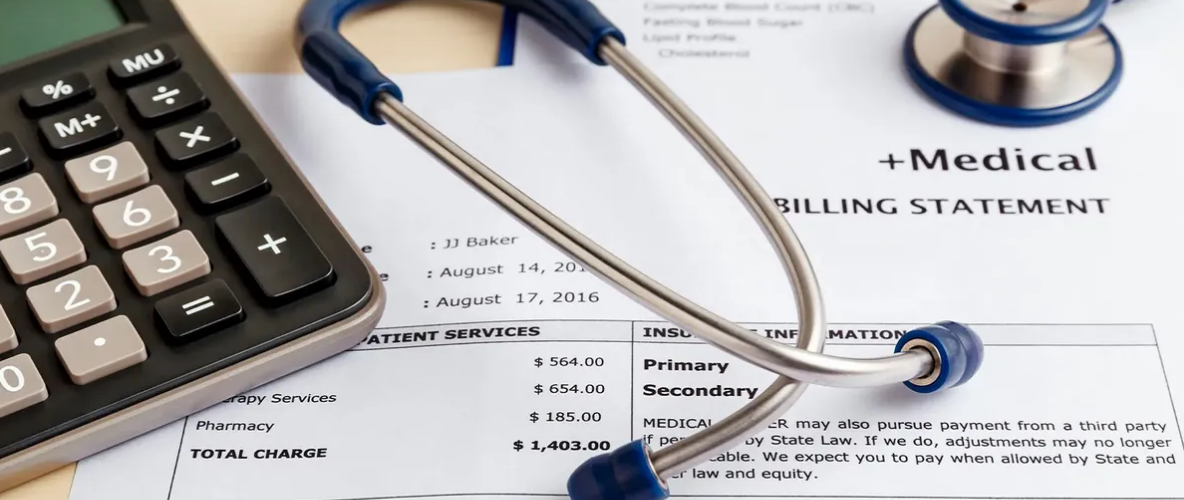

Outsourcing Medical Billing and Coding Services: Streamlining Your Practice's Financial Operations5/8/2023 Outsourcing Medical Billing and Coding Services: Streamlining Your Practice's Financial Operations Outsourcing medical billing and coding services can save time and money for medical practices while improving accuracy and compliance. Learn more about the benefits and process of outsourcing these essential services. Medical billing and coding are crucial components of any medical practice's financial operations. However, managing these tasks in-house can be time-consuming and expensive, especially for smaller practices. Outsourcing medical billing and coding services can streamline operations and improve accuracy, compliance, and revenue cycle management. In this article, we'll explore the benefits of outsourcing medical billing and coding services, the process of finding a reliable provider, and how to ensure a successful partnership. Benefits of Outsourcing Medical Billing and Coding Services:

Finding a Reliable Medical Billing and Coding Provider:

Ensuring a Successful Partnership:

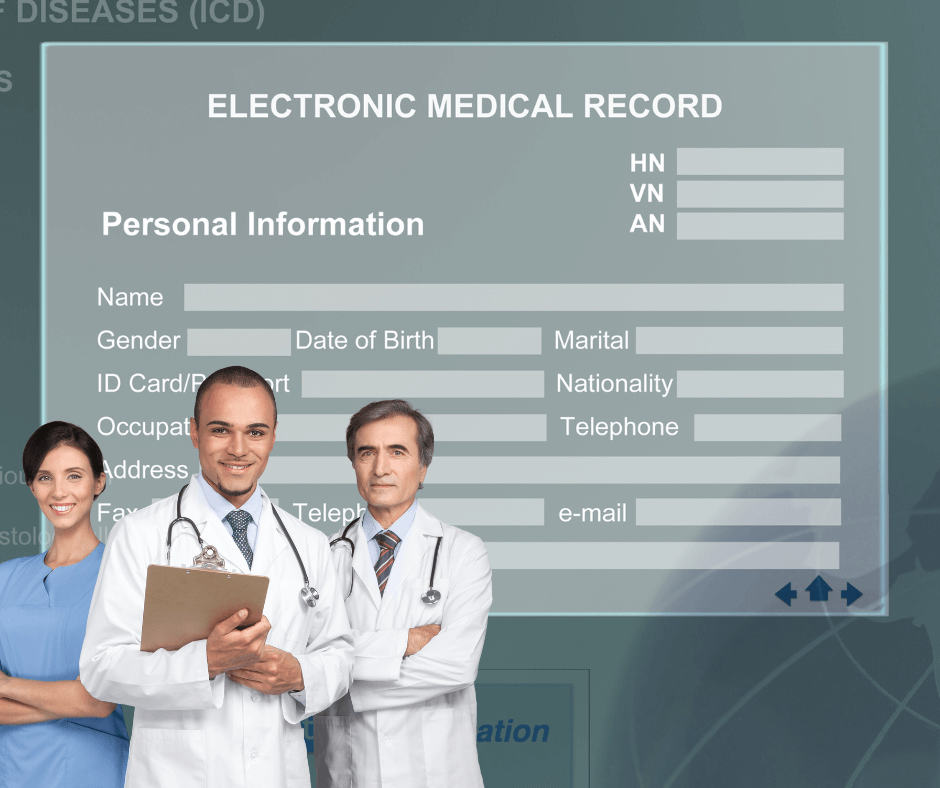

Outsourcing medical billing and coding services can be a game-changer for medical practices looking to streamline operations and improve financial performance. By following the best practices outlined in this article, practices can find a reliable and effective provider and achieve success in partnership. Maximize Your Medical Practice's Earnings with These 7 Revenue Cycle Management Services Explore 7 powerful revenue cycle management services that can significantly enhance the financial performance of your medical practice and streamline operations. Go Healthcare LLC is a leading provider of comprehensive revenue cycle management services for medical practices. By leveraging our expertise, we help healthcare providers like you maximize earnings, streamline operations, and improve patient satisfaction. In this article, we will discuss seven key revenue cycle management services that can help your medical practice achieve better financial performance. Patient Registration and Eligibility Verification One of the most critical revenue cycle management services for medical practices is efficient patient registration and eligibility verification. Go Healthcare LLC's team ensures that your patients' information is accurate and complete, while also verifying their insurance eligibility. This process minimizes errors and reduces claim denials, helping to improve your practice's revenue cycle performance. Medical Billing and Coding Accurate medical billing and coding are essential for maintaining a healthy revenue cycle. Our revenue cycle management services for medical practices include specialized professionals who are well-versed in the latest medical coding standards. This ensures that your practice submits accurate claims and receives the correct reimbursement for the services provided. Claim Submission and Tracking Submitting and tracking medical claims can be a time-consuming and complex task. Our revenue cycle management services for medical practices streamline this process by efficiently submitting claims to payers and tracking their status. This service ensures that claims are paid promptly and helps identify any potential issues that could lead to denials or delays. Denial Management One of the most frustrating aspects of revenue cycle management for medical practices is dealing with claim denials. Go Healthcare LLC's denial management service helps you identify the root causes of denials and implement corrective actions to prevent future occurrences. By proactively addressing these issues, our revenue cycle management services for medical practices can significantly improve your practice's bottom line. Payment Posting and Reconciliation Proper payment posting and reconciliation are vital to maintaining an accurate account of your practice's revenue. Our revenue cycle management services for medical practices include the meticulous posting of payments and adjustments to patient accounts. This ensures that your practice's financial records are up-to-date and accurate, allowing for better decision-making and financial management. Patient Collections Patient collections can be a sensitive topic, but they are a crucial component of revenue cycle management services for medical practices. Go Healthcare LLC handles this process with professionalism and care, ensuring that your patients fully understand their financial responsibilities while preserving the provider-patient relationship. Our team employs best practices to collect outstanding balances and improve your practice's overall revenue. Analytics and Reporting A successful revenue cycle management strategy relies on data-driven insights. Go Healthcare LLC's revenue cycle management services for medical practices include detailed analytics and reporting to help you make informed decisions about your practice's financial performance. By monitoring key performance indicators (KPIs) and identifying trends, we can help you optimize your revenue cycle and maximize your practice's earnings. By partnering with Go Healthcare LLC, your medical practice can take advantage of these seven key revenue cycle management services to boost your bottom line and improve patient satisfaction. Don't let the complexities of the revenue cycle hold your practice back - contact Go Healthcare LLC today to learn how our revenue cycle management services for medical practices can make a difference for you. Top 10 EHR Software Solutions Revolutionizing Healthcare Discover the top 10 EHR software solutions that are transforming the healthcare industry, streamlining workflows, and enhancing patient care. The healthcare industry has been undergoing a significant transformation, with Electronic Health Record (EHR) software playing a pivotal role in this change. EHR software has revolutionized the way healthcare providers manage patient information, making it easier to access, update, and share critical data. In this article, we will explore the top 10 EHR software solutions that are redefining the healthcare landscape. Epic Systems Epic is one of the most widely used EHR software systems in the United States. It offers an integrated platform that caters to both small and large healthcare organizations. This EHR software is known for its robust functionality, seamless interoperability, and user-friendly interface, making it a favorite among healthcare providers. Cerner Cerner is another leading EHR software that has been around for decades, providing healthcare organizations with a comprehensive suite of tools to manage patient information. Its EHR software is designed to improve efficiency, enhance patient care, and streamline workflows, making it a reliable choice for healthcare providers. Allscripts Allscripts EHR software is designed to deliver a seamless and connected healthcare experience. With its flexible and customizable features, Allscripts caters to a wide range of healthcare specialties and organizations. This EHR software emphasizes interoperability, allowing for easy data exchange among different healthcare providers. Meditech Meditech is a popular EHR software that has been serving the healthcare industry for over 50 years. Its EHR software is designed to adapt to the unique needs of healthcare organizations, providing a comprehensive and intuitive solution for managing patient information. Meditech's EHR software also emphasizes patient safety and care coordination. Athenahealth Athenahealth is a cloud-based EHR software that offers a range of services, including practice management, revenue cycle management, and patient engagement tools. This EHR software is known for its user-friendly interface and robust analytics capabilities, making it a popular choice for healthcare providers looking to improve their overall efficiency. eClinicalWorks eClinicalWorks is a versatile EHR software that caters to a wide range of healthcare specialties. This EHR software focuses on delivering an easy-to-use and customizable platform, allowing healthcare providers to tailor the software to their specific needs. eClinicalWorks also offers telehealth capabilities, making it a suitable option for remote patient care. Greenway Health Greenway Health's EHR software, Intergy, is designed to simplify healthcare management for both small and large practices. This EHR software offers a wide range of tools and features, including billing, scheduling, and reporting capabilities. Greenway Health's EHR software also emphasizes patient engagement and care coordination. NextGen Healthcare NextGen Healthcare's EHR software is an all-in-one solution for healthcare providers looking to streamline their practice management. With features like electronic prescribing, patient portal, and telehealth capabilities, NextGen's EHR software is designed to enhance patient care and improve overall efficiency. Practice Fusion Practice Fusion is a cloud-based EHR software that offers a comprehensive suite of tools for managing patient information. This EHR software is known for its affordability and ease of use, making it a popular choice for small practices and individual providers. Practice Fusion's EHR software also emphasizes patient engagement and care coordination. CareCloud CareCloud's EHR software is designed to help healthcare providers manage their practice more effectively. With features like patient scheduling, billing, and reporting, CareCloud's EHR software is a comprehensive solution for healthcare organizations of all sizes. This EHR software also focuses on improving patient Maximize Your Medical Experience: 7 Unbeatable Patient Portal Software Solutions Discover the top patient portal software options that can revolutionize your medical experience, streamlining communication and providing seamless access to vital health information. When it comes to managing your healthcare, convenience and accessibility are essential. Patient portal software provides a secure, user-friendly platform for managing medical information, appointments, and communication with healthcare providers. We've compiled a list of the top 7 patient portal software solutions that are transforming the way patients and providers interact, revolutionizing the medical experience. Epic MyChart: The Comprehensive Choice Epic MyChart, one of the most widely-used patient portal software systems, provides a comprehensive experience for both patients and healthcare providers. From appointment scheduling to prescription refills, Epic MyChart offers an intuitive interface that integrates seamlessly with the existing electronic health record (EHR) system. With a user-friendly mobile app, patients can easily access their medical information on the go. Cerner HealtheLife: The Connected Solution Cerner HealtheLife is a top patient portal software choice, offering a fully integrated approach to healthcare management. Patients can securely access their health records, schedule appointments, and communicate with healthcare providers, all within one platform. The connected portal also offers unique features such as health tracking and wellness resources, empowering patients to take control of their health journey. Athenahealth: The Cloud-Based Contender As a leading patient portal software, Athenahealth leverages cloud-based technology to streamline medical information management. Its user-friendly interface allows patients to easily access their health records, schedule appointments, and communicate with providers. With robust customization options, Athenahealth can adapt to the specific needs of any healthcare practice. Medfusion: The Patient-Focused Platform Medfusion prides itself on its patient-centric approach to patient portal software. With a focus on accessibility, Medfusion provides an easy-to-use platform for managing health records, appointments, and communication. In addition, the software offers telehealth capabilities, allowing patients to connect with their healthcare providers remotely, further enhancing the patient experience. Allscripts FollowMyHealth: The Interoperable Interface As a top patient portal software, Allscripts FollowMyHealth connects patients and providers across different EHR systems. The portal's interoperability ensures patients have seamless access to their health records, regardless of which EHR their provider uses. With secure messaging, appointment scheduling, and telehealth capabilities, FollowMyHealth provides a comprehensive solution for patient engagement. eClinicalWorks: The Versatile Tool eClinicalWorks offers a versatile patient portal software solution that caters to a wide range of healthcare practices. With customizable features, eClinicalWorks can adapt to the unique needs of any practice. Patients can securely access their health records, schedule appointments, and communicate with their healthcare providers, all while enjoying a user-friendly experience. Greenway Health: The Collaborative Choice Greenway Health provides a patient portal software that promotes collaboration between patients and providers. With features such as secure messaging, appointment scheduling, and prescription refills, Greenway Health makes it easy for patients to take an active role in their healthcare. The software also offers valuable patient education resources to support informed decision-making. In today's digital age, patient portal software is an essential tool for managing your healthcare experience. With a range of top solutions available, you can find the perfect platform to streamline communication and access vital health information. Whether you're looking for a comprehensive, connected, or patient-focused solution, these patient portal software options offer something for everyone. Maximizing Revenue and Efficiency: The Benefits of Outsourcing Medical Billing and Coding Services5/4/2023 Maximizing Revenue and Efficiency: The Benefits of Outsourcing Medical Billing and Coding Services Discover how outsourcing medical billing and coding services can streamline your practice's operations and boost revenue. Learn about the benefits of entrusting these critical tasks to experienced professionals. Medical billing and coding are integral components of any medical practice. Ensuring that claims are accurately coded and submitted on time can make the difference between a thriving practice and one struggling to keep the lights on. But with the complexity of today's healthcare system and the sheer volume of claims to process, many practices are turning to outsourcing as a solution. In this post, we explore the benefits of outsourcing medical billing and coding services and how it can help your practice achieve maximum revenue and efficiency.

Sources:

Understanding Medicare's Recovery Audit Contractor (RAC) Program for Accurate Healthcare Claims5/3/2023 Mastering Medicare Compliance: Navigating the Recovery Audit Contractor (RAC) Program for Accurate Healthcare Claims Explore the Recovery Audit Contractor (RAC) program, responsible for identifying and recovering improper Medicare payments in healthcare claims. Learn about the RAC process, types of improper payments, provider appeals, education initiatives, and key aspects of the program to ensure compliance and maintain Medicare integrity. Recovery Audit Contractors (RACs) are private companies contracted by the Centers for Medicare & Medicaid Services (CMS) to identify and correct improper Medicare payments. Their primary role is to review post-payment healthcare claims submitted by healthcare providers and identify any discrepancies or errors that may have led to overpayments or underpayments. RAC Program Objective The RAC program was established in response to the Medicare Modernization Act of 2003 and the Tax Relief and Health Care Act of 2006. The primary objective of the program is to ensure the integrity of the Medicare system by identifying and recovering improper payments, while also preventing future errors through provider education. RAC Process RACs utilize a combination of automated and manual review processes to examine healthcare claims. They review claims to identify potential errors, such as incorrect billing codes, duplicate payments, non-covered services, or incorrect payment amounts. a) Automated Review: RACs use software algorithms to identify billing patterns and potential errors. This process can identify high-risk claims without human intervention. b) Manual Review: When the automated review identifies a potential error or when the claim is complex, RACs perform a manual review. This involves a detailed examination of the medical record and supporting documentation by a certified medical professional. Types of Improper Payments RACs primarily focus on identifying four types of improper payments: a) Overpayments: When a healthcare provider receives more reimbursement than they are entitled to for a service. b) Underpayments: When a healthcare provider receives less reimbursement than they are entitled to for a service. c) Non-covered Services: When a healthcare provider receives reimbursement for a service that is not covered by Medicare. d) Incorrectly Coded Services: When a healthcare provider receives reimbursement for a service based on an incorrect billing code. Provider Appeals Process Healthcare providers have the right to appeal RAC determinations. The appeals process consists of five levels, allowing providers multiple opportunities to contest the decision. RACs are required to provide detailed rationale for their decisions and return any funds collected if the appeal is successful. Provider Education and Outreach RACs are responsible for educating healthcare providers on proper billing practices to prevent future errors. This includes conducting outreach programs, providing educational materials, and offering webinars to ensure providers have the necessary resources to comply with Medicare billing rules. Program Performance The RAC program has been successful in recovering billions of dollars in improper payments since its inception. It has also led to significant improvements in billing practices, contributing to the overall integrity of the Medicare system. In conclusion, Recovery Audit Contractors play a crucial role in ensuring the proper use of Medicare funds. By identifying and recovering improper payments and educating healthcare providers on correct billing practices, RACs help maintain the integrity of the Medicare system and safeguard its resources for future beneficiaries. Here are some additional important aspects of the Recovery Audit Contractor (RAC) program: Contingency Fee Structure: RACs are paid on a contingency fee basis, meaning they receive a percentage of the improper payments they recover. This fee structure incentivizes RACs to identify and recover as many improper payments as possible. However, some critics argue that this model may encourage RACs to be overly aggressive in their audits. RAC Jurisdictions: The United States is divided into several RAC regions, with each RAC responsible for a specific jurisdiction. This regional approach allows RACs to focus on the unique healthcare landscapes and trends within their respective regions, enhancing their ability to identify and recover improper payments. Look-Back Period: RACs typically review claims within a three-year look-back period, starting from the date of service. This means that healthcare providers should maintain accurate and complete records for at least three years to ensure they can adequately respond to any RAC audits. RAC Validation Contractor (RVC): The RAC Validation Contractor is an independent entity contracted by CMS to oversee the RAC program's accuracy and effectiveness. The RVC conducts independent reviews of RAC determinations, ensuring that RACs are adhering to Medicare rules and regulations and maintaining a high level of accuracy. Provider Compliance Group (PCG): The Provider Compliance Group is a CMS division responsible for coordinating all Medicare provider compliance efforts, including the RAC program. The PCG plays a crucial role in ensuring that the RAC program aligns with the overall goals and objectives of the Medicare system. Limitations on RAC Audits: To minimize the administrative burden on healthcare providers, CMS has implemented some limitations on RAC audits. For instance, RACs are subject to a limit on the number of medical records they can request from a provider within a specified period. Additionally, RACs must complete their reviews within specified timeframes to minimize disruption to providers. Continuous Program Improvement: CMS regularly evaluates and updates the RAC program to enhance its effectiveness, address stakeholder concerns, and adapt to the evolving healthcare landscape. This may include modifying audit methodologies, updating regulations, and refining the RAC program's focus areas. By understanding these additional aspects of the RAC program, healthcare providers can better navigate the audit process and ensure compliance with Medicare billing rules and regulations.  Explore the Recovery Audit Contractor (RAC) program, responsible for identifying and recovering improper Medicare payments in healthcare claims. Learn about the RAC process, types of improper payments, provider appeals, education initiatives, and key aspects of the program to ensure compliance and maintain Medicare integrity. Reading references related to the Recovery Audit Contractor (RAC) program:

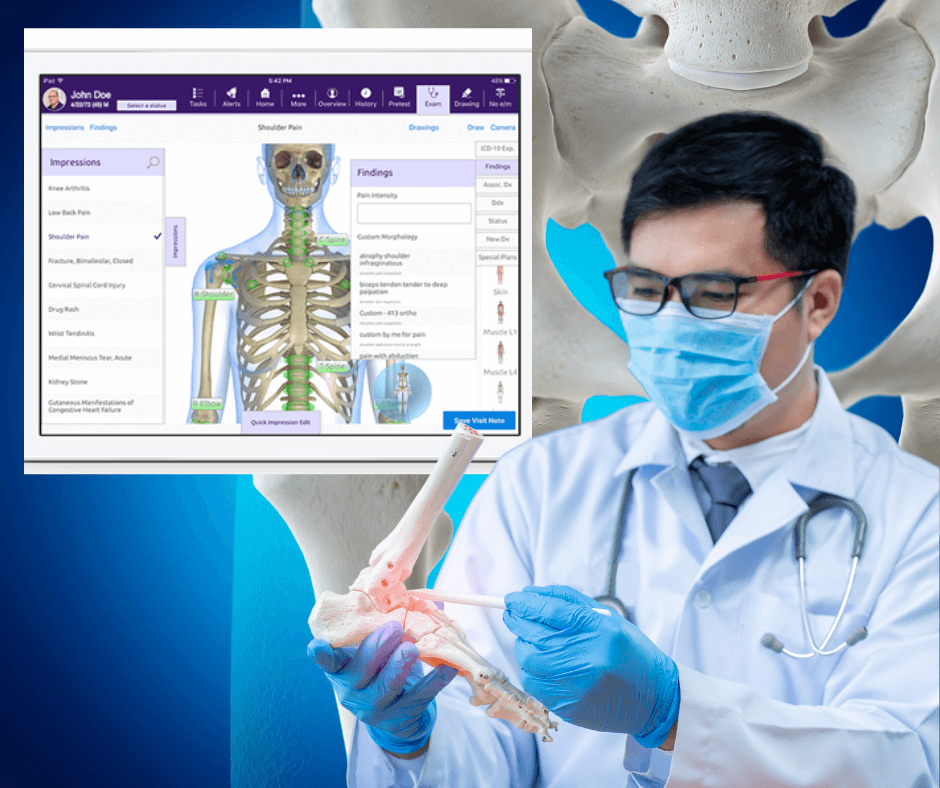

Centers for Medicare & Medicaid Services. (2021). Recovery Audit Program. Retrieved from https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Recovery-Audit-Program Centers for Medicare & Medicaid Services. (2021). Recovery Audit Program – Provider Resources. Retrieved from https://www.cms.gov/Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Recovery-Audit-Program/Provider-Resources Department of Health and Human Services, Office of Inspector General. (2019). Medicare Recovery Audit Contractors and CMS’s Actions to Address Improper Payments, Referrals of Potential Fraud, and Performance. Retrieved from https://oig.hhs.gov/oas/reports/region4/41804058.asp American Medical Association. (n.d.). Recovery Audit Contractors (RAC) audits. Retrieved from https://www.ama-assn.org/practice-management/medicare/recovery-audit-contractors-rac-audits American Hospital Association. (n.d.). Recovery Audit Contractors (RACs). Retrieved from https://www.aha.org/issues/recovery-audit-contractors-racs These references provide a comprehensive overview of the RAC program, its objectives, processes, and impact on healthcare claims, as well as insights into the program's performance and related concerns. The Ultimate Guide to Telemedicine Services: Everything You Need to Know As the demand for remote healthcare increases, telemedicine services are becoming more popular. In this comprehensive guide, we explore the benefits, limitations, and best practices of telemedicine to help patients and medical professionals understand how to utilize this innovative technology. Telemedicine services have revolutionized the healthcare industry by providing patients with remote access to medical services. As the world adapts to the new normal of social distancing and remote work, the demand for telemedicine services is on the rise. In this guide, we will explore everything you need to know about telemedicine services, including their benefits, limitations, and best practices. Benefits of Telemedicine Services: Telemedicine services have numerous benefits, such as increased access to medical care, reduced costs, and improved patient outcomes. We will discuss these benefits in detail, along with how telemedicine services are helping patients with chronic illnesses and mental health issues. Limitations of Telemedicine Services: While telemedicine services have many advantages, there are also some limitations to consider. In this section, we will explore the challenges faced by medical professionals when using telemedicine services, including issues with insurance reimbursement and technological barriers. Best Practices for Telemedicine Services: To make the most of telemedicine services, it is important to understand best practices for their use. We will discuss strategies for selecting a telemedicine provider, preparing for a telemedicine visit, and ensuring privacy and security during remote consultations. Telemedicine services offer numerous benefits to patients and medical professionals alike. By providing remote access to medical care, telemedicine services are improving healthcare outcomes and reducing costs. As the world continues to adapt to new norms, telemedicine services are becoming increasingly popular. With this comprehensive guide, patients and medical professionals can understand how to utilize telemedicine services to their fullest potential. Boost Your Medical Practice's Financial Health with Revenue Cycle Management Effective revenue cycle management is vital for the financial success of your medical practice. Learn how to optimize your revenue cycle with our comprehensive guide and boost your bottom line. As a medical professional, your top priority is to provide quality care to your patients. However, running a successful medical practice also requires attention to the business side of things, including revenue cycle management. Revenue cycle management is the process of managing the financial aspects of your practice, from patient registration to billing and collections. In this comprehensive guide, we'll discuss the key elements of revenue cycle management and provide tips to help you optimize your revenue cycle and improve your financial health. Patient Registration and Eligibility Verification One of the critical steps in revenue cycle management is patient registration and eligibility verification. Accurate and timely registration can prevent billing errors and ensure that patients are eligible for coverage under their insurance plan. In addition, verifying patient eligibility before providing services can help prevent denials and reduce the risk of non-payment. Coding and Charge Capture Coding and charge capture are the next steps in the revenue cycle management process. Accurate coding ensures that claims are submitted correctly the first time, reducing the risk of denials and delays in payment. Charge capture ensures that all services provided are accurately recorded and billed for, optimizing revenue. Claims Submission and Follow-Up Submitting claims and following up on them is a crucial part of revenue cycle management. Timely and accurate claim submission can improve cash flow and reduce the risk of denials. Effective follow-up on denied or delayed claims can also help prevent revenue loss. Patient Payments and Collections Patient payments and collections are the final steps in revenue cycle management. Clear communication with patients about their financial responsibility and providing multiple payment options can improve collections and reduce bad debt. Timely and effective collections can help ensure that your practice receives the revenue it is owed. Effective revenue cycle management is essential for the financial health of your medical practice. By following the steps outlined in this guide, you can optimize your revenue cycle and improve your bottom line. Don't let revenue cycle management be an afterthought - make it a priority and reap the financial benefits. 10 Innovative Features of Pain Management EHR Systems That Are Transforming Patient Care Discover the top 10 innovative features of pain management EHR systems that are transforming patient care and enhancing medical practices' efficiency. In today's fast-paced healthcare industry, Electronic Health Record (EHR) systems are becoming increasingly essential. Specifically, pain management EHR systems have made significant strides in helping physicians and healthcare providers deliver more effective care to patients suffering from chronic pain. In this article, we'll explore the top 10 innovative features of pain management EHR systems that are transforming patient care and streamlining medical practices. Customizable Templates for Pain Management A major advantage of pain management EHR systems is the availability of customizable templates. These templates allow physicians to efficiently document patient encounters, including pain assessment, treatment plans, and progress notes. This not only saves time but also ensures accuracy and consistency in documentation. Integrated Pain Assessment Tools Pain management EHR systems often come with integrated pain assessment tools, such as the Visual Analog Scale (VAS) and the Numeric Rating Scale (NRS). These tools help clinicians quickly and accurately assess a patient's pain levels, which is crucial in determining the most appropriate treatment plan. E-Prescribing and Medication Management The e-prescribing feature in pain management EHR systems enables healthcare providers to electronically send prescriptions to pharmacies, reducing the risk of medication errors. Additionally, pain management EHR systems often have medication management capabilities, allowing physicians to track medication usage, monitor for potential drug interactions, and assess patient adherence to prescribed treatments. Secure Communication and Collaboration Tools Pain management EHR systems provide secure communication and collaboration tools, enabling healthcare providers to easily share patient information and collaborate on treatment plans. This is particularly important in pain management, where a multidisciplinary approach is often necessary to address the complexities of chronic pain. Integrated Billing and Scheduling Pain management EHR systems often include integrated billing and scheduling features, allowing medical practices to streamline their administrative processes. This reduces the risk of billing errors, ensures timely reimbursement, and enhances overall practice efficiency. Patient Portal and Engagement Tools Patient engagement is essential for successful pain management. Many pain management EHR systems now offer patient portals, enabling patients to access their health information, schedule appointments, request prescription refills, and communicate with their healthcare providers. This promotes patient involvement in their care and can improve treatment outcomes. Telemedicine Capabilities Telemedicine is becoming increasingly popular in pain management, as it allows healthcare providers to remotely monitor and manage patients' pain levels. Pain management EHR systems with telemedicine capabilities enable virtual consultations and facilitate remote access to patient data, ensuring continuity of care. Clinical Decision Support Clinical decision support (CDS) tools in pain management EHR systems provide healthcare providers with evidence-based recommendations, helping them make informed decisions about patient care. This can lead to more accurate diagnoses, better treatment plans, and improved patient outcomes. Reporting and Analytics Pain management EHR systems often include reporting and analytics tools, allowing healthcare providers to track and analyze data related to patient outcomes, treatment efficacy, and practice performance. This information can be invaluable in identifying trends, improving care delivery, and optimizing practice efficiency. Interoperability and Health Information Exchange Interoperability is crucial in the healthcare industry. Pain management EHR systems that support health information exchange (HIE) enable seamless sharing of patient data between healthcare providers, ensuring comprehensive and coordinated care for patients suffering from chronic pain. 10 Proven Patient Engagement Strategies for Improved Outcomes: A Comprehensive Guide Are you a medical professional looking for effective strategies to engage your patients and improve their outcomes? Read on for 10 proven patient engagement strategies backed by research and real-life experience. Engaging patients is vital for medical practices seeking to improve outcomes and build long-term relationships with patients. However, many medical professionals struggle to implement effective patient engagement strategies. To help you improve patient engagement and drive better outcomes, we've compiled a list of 10 proven strategies that have been tested and proven by experts in the field. Read on to learn more. Communicate Clearly and Effectively Clear and effective communication is key to patient engagement. When communicating with patients, use simple and jargon-free language, avoid medical terms that patients may not understand, and listen actively to their concerns. Patients who feel heard and understood are more likely to engage in their care and follow through on recommended treatments. Use Technology to Connect with Patients Technology has revolutionized patient engagement by providing new ways for medical professionals to connect with patients. Use online portals, mobile apps, and other digital tools to communicate with patients, share information, and engage them in their care. Educate Patients about Their Conditions Educating patients about their conditions is critical for patient engagement. Provide patients with clear and accurate information about their diagnosis, treatment options, and prognosis. Patients who are well-informed about their conditions are more likely to engage in their care and make informed decisions about their health. Involve Patients in Care Decisions Involving patients in care decisions is another effective patient engagement strategy. Provide patients with information about different treatment options, and work with them to develop a care plan that fits their needs and preferences. Provide Personalized Care Patients are more likely to engage in their care when they feel that their medical professionals understand their unique needs and preferences. Provide personalized care by taking the time to get to know your patients, addressing their concerns, and tailoring your approach to their individual needs. Offer Remote Monitoring and Telehealth Services Remote monitoring and telehealth services are increasingly popular patient engagement strategies that allow medical professionals to monitor patients' health remotely and provide care outside of traditional office settings. These services are particularly useful for patients with chronic conditions who require ongoing monitoring and support. Use Gamification to Engage Patients Gamification is an innovative patient engagement strategy that uses game-like elements to motivate patients to engage in their care. Use gamification to encourage patients to track their progress, set goals, and stay motivated to achieve better outcomes. Provide Emotional Support Patients who feel emotionally supported are more likely to engage in their care and experience better outcomes. Provide emotional support by showing empathy, validating patients' concerns, and referring them to support groups or counseling services if necessary. Collect Patient Feedback and Act on It Collecting patient feedback is critical for improving patient engagement. Use surveys and other feedback mechanisms to gather patients' perspectives on their care, and use this feedback to make improvements to your practice. Foster a Culture of Patient Engagement Finally, to improve patient engagement in your practice, you must foster a culture that values patient engagement and puts patients at the center of care. Encourage your staff to prioritize patient engagement, provide ongoing training and support, and recognize and reward staff members who excel in patient engagement. 10 Top Telehealth Solutions Elevating Primary Care Providers' Practices Discover the top telehealth solutions that are transforming the way primary care providers deliver healthcare services to patients, enhancing accessibility, and improving outcomes. In recent years, telehealth has emerged as a key component in the healthcare sector, providing primary care providers with innovative and efficient ways to connect with patients. Telehealth solutions for primary care providers have significantly improved the delivery of care, enabling better access and convenience for both practitioners and their patients. In this blog post, we'll explore 10 top telehealth solutions that are redefining primary care services. Amwell One of the leading telehealth solutions for primary care providers, Amwell offers a comprehensive platform for delivering care remotely. With a robust suite of tools, Amwell enables virtual consultations, remote patient monitoring, and seamless integration with electronic health records (EHR). Teladoc Teladoc is a popular telehealth solution for primary care providers who are looking to offer patients on-demand access to healthcare services. With a user-friendly app and an extensive network of healthcare professionals, Teladoc makes it easy for patients to connect with primary care providers from the comfort of their own homes. MDLive Another well-known telehealth solution for primary care providers is MDLive, a platform that offers virtual visits, e-prescriptions, and behavioral health services. MDLive helps primary care providers expand their reach, offering care to patients in remote locations or those with mobility challenges. Doctor on Demand Doctor on Demand is a telehealth solution for primary care providers that focuses on delivering high-quality, video-based consultations. The platform also offers additional services such as preventive care, chronic care management, and mental health support. SnapMD SnapMD is a telehealth solution for primary care providers that offers a secure, cloud-based platform for virtual consultations. With its user-friendly interface and comprehensive features, SnapMD enables primary care providers to deliver personalized care to patients remotely. eVisit eVisit is a telehealth solution for primary care providers that focuses on simplicity and efficiency. The platform offers an easy-to-use interface for both providers and patients, enabling secure video consultations and seamless integration with EHR systems. GlobalMed GlobalMed is a telehealth solution for primary care providers that offers a wide range of services, including virtual consultations, remote patient monitoring, and telestroke care. With its focus on innovation, GlobalMed helps primary care providers improve patient outcomes and reduce healthcare costs. PlushCare PlushCare is a telehealth solution for primary care providers that offers a wide range of services, including virtual consultations, prescription management, and lab test coordination. The platform also focuses on preventive care and chronic condition management, helping primary care providers to deliver comprehensive care remotely. Chiron Health Chiron Health is a telehealth solution for primary care providers that offers a secure, cloud-based platform for virtual consultations. The platform integrates with existing EHR systems and offers features such as appointment scheduling and billing, making it an attractive option for primary care providers looking to expand their telehealth services. Spruce Health Spruce Health is a telehealth solution for primary care providers that offers secure messaging, video consultations, and care coordination tools. The platform is designed to help primary care providers streamline their workflows and improve patient engagement. These top telehealth solutions for primary care providers are transforming the way healthcare services are delivered, making it easier for practitioners to reach patients and offer high-quality care. As the healthcare landscape continues to evolve, embracing telehealth solutions will become increasingly vital for primary care providers looking to stay competitive and deliver exceptional patient experiences. Top 10 EHR Software Solutions Revolutionizing Healthcare Discover the top 10 EHR software solutions that are transforming the healthcare industry, streamlining workflows, and enhancing patient care. The healthcare industry has been undergoing a significant transformation, with Electronic Health Record (EHR) software playing a pivotal role in this change. EHR software has revolutionized the way healthcare providers manage patient information, making it easier to access, update, and share critical data. In this article, we will explore the top 10 EHR software solutions that are redefining the healthcare landscape. Epic Systems Epic is one of the most widely used EHR software systems in the United States. It offers an integrated platform that caters to both small and large healthcare organizations. This EHR software is known for its robust functionality, seamless interoperability, and user-friendly interface, making it a favorite among healthcare providers. Cerner Cerner is another leading EHR software that has been around for decades, providing healthcare organizations with a comprehensive suite of tools to manage patient information. Its EHR software is designed to improve efficiency, enhance patient care, and streamline workflows, making it a reliable choice for healthcare providers. Allscripts Allscripts EHR software is designed to deliver a seamless and connected healthcare experience. With its flexible and customizable features, Allscripts caters to a wide range of healthcare specialties and organizations. This EHR software emphasizes interoperability, allowing for easy data exchange among different healthcare providers. Meditech Meditech is a popular EHR software that has been serving the healthcare industry for over 50 years. Its EHR software is designed to adapt to the unique needs of healthcare organizations, providing a comprehensive and intuitive solution for managing patient information. Meditech's EHR software also emphasizes patient safety and care coordination. Athenahealth Athenahealth is a cloud-based EHR software that offers a range of services, including practice management, revenue cycle management, and patient engagement tools. This EHR software is known for its user-friendly interface and robust analytics capabilities, making it a popular choice for healthcare providers looking to improve their overall efficiency. eClinicalWorks eClinicalWorks is a versatile EHR software that caters to a wide range of healthcare specialties. This EHR software focuses on delivering an easy-to-use and customizable platform, allowing healthcare providers to tailor the software to their specific needs. eClinicalWorks also offers telehealth capabilities, making it a suitable option for remote patient care. Greenway Health Greenway Health's EHR software, Intergy, is designed to simplify healthcare management for both small and large practices. This EHR software offers a wide range of tools and features, including billing, scheduling, and reporting capabilities. Greenway Health's EHR software also emphasizes patient engagement and care coordination. NextGen Healthcare NextGen Healthcare's EHR software is an all-in-one solution for healthcare providers looking to streamline their practice management. With features like electronic prescribing, patient portal, and telehealth capabilities, NextGen's EHR software is designed to enhance patient care and improve overall efficiency. Practice Fusion Practice Fusion is a cloud-based EHR software that offers a comprehensive suite of tools for managing patient information. This EHR software is known for its affordability and ease of use, making it a popular choice for small practices and individual providers. Practice Fusion's EHR software also emphasizes patient engagement and care coordination. CareCloud CareCloud's EHR software is designed to help healthcare providers manage their practice more effectively. With features like patient scheduling, billing, and reporting, CareCloud's EHR software is a comprehensive solution for healthcare organizations of all sizes. This EHR software also focuses on improving patient Top 7 Benefits of Outsourcing Medical Billing and Coding Services for Your Practice Discover the advantages of outsourcing medical billing and coding services to experts. Learn how it can streamline your practice, reduce errors, and improve revenue cycles. Read on for more information. As a medical professional, you know that billing and coding can be a time-consuming and complicated process. It requires accuracy, attention to detail, and knowledge of constantly changing regulations. That's why outsourcing medical billing and coding services has become a popular solution for many healthcare providers. In this post, we'll explore the benefits of outsourcing these services for your practice. Streamline your practice operations - Outsourcing medical billing and coding services can help you save time and streamline your practice operations. Instead of spending hours on billing and coding tasks, you can focus on patient care and other core activities. Reduce errors and rejections - Medical billing and coding errors can be costly for your practice. Outsourcing to experts who specialize in this area can reduce the risk of errors and rejections, which can ultimately improve your revenue cycle. Increase revenue - With accurate coding and timely submissions, outsourcing medical billing and coding services can help you increase your revenue. It can also help you identify and correct any potential revenue leaks. Stay up-to-date with regulations - Outsourcing to a reputable medical billing and coding company can ensure that you stay up-to-date with the latest regulations and compliance requirements. This can help you avoid penalties and fines. Access to expertise - Medical billing and coding companies employ experts who are trained and experienced in this field. By outsourcing, you can access their expertise without having to invest in training and hiring your own staff. Improve patient satisfaction - Accurate and timely billing can improve patient satisfaction. Outsourcing can ensure that patients receive clear and concise bills, which can reduce confusion and frustration. Cost-effective solution - Outsourcing medical billing and coding services can be a cost-effective solution for your practice. You can avoid the expenses associated with hiring and training your own staff, as well as investing in software and equipment Outsourcing medical billing and coding services can offer many benefits for your practice. It can streamline your operations, reduce errors, increase revenue, and improve patient satisfaction. By choosing a reputable and experienced provider, you can ensure that your billing and coding needs are taken care of, while you focus on providing quality patient care. How to Successfully Appeal a Medical Prior Authorization Denial: A Step-by-Step Guide Learn how to appeal a medical prior authorization denial with our comprehensive guide that includes actionable tips and expert advice from GoHealthcare Practice Solutions. Dealing with a medical prior authorization denial can be a frustrating experience for both patients and healthcare providers. It's essential to know how to navigate the appeals process to ensure the best possible outcome. In this blog post, we'll guide you through the steps to appeal a medical prior authorization denial effectively. As experts in the field, GoHealthcare Practice Solutions is here to help you every step of the way. Visit our website at https://www.gohealthcarellc.com for more information. Step 1: Review the Denial Letter When you receive a medical prior authorization denial, the first thing you should do is carefully review the denial letter. This letter will provide you with essential information about why your request was denied and how to initiate the appeals process. Step 2: Gather Supporting Documents Collect all relevant documentation, including medical records, physician's notes, and any additional evidence that supports the medical necessity of the treatment or service. These documents will be critical in building a strong appeal case. Step 3: Write a Letter of Appeal Compose a letter of appeal that clearly and concisely outlines the reasons for your request. Be sure to include the patient's name, insurance information, and any relevant medical history. Additionally, highlight the supporting documents you have gathered and emphasize the medical necessity of the treatment. Step 4: Submit the Appeal Submit your appeal, along with all supporting documentation, to the appropriate insurance company or payer. Be sure to follow their specific guidelines and meet any deadlines they have in place. Step 5: Follow Up on the Appeal After submitting your appeal, be proactive in following up with the insurance company to ensure they have received it and are actively reviewing your case. Keep track of any communication and make note of any additional information or documentation they request. Step 6: Be Prepared for Additional Steps In some cases, the appeals process may involve additional steps, such as peer-to-peer reviews or independent medical reviews. Be prepared to provide any necessary information and engage with the process as needed. Step 7: Consult with Experts Navigating the appeals process can be complex, and it's essential to have knowledgeable experts on your side. GoHealthcare Practice Solutions is here to help you with all aspects of the medical prior authorization process, including appealing denials. Visit our website at https://www.gohealthcarellc.com to learn more about our services and how we can assist you. By following these steps, you'll be well-prepared to appeal a medical prior authorization denial effectively. Remember that persistence and attention to detail are key components of a successful appeal. Good luck! Reading References and Sources:

7 Outstanding Patient Portal Solutions for Today's Healthcare Providers Discover 7 exceptional patient portal solutions for healthcare providers that enhance patient engagement, streamline communication, and improve overall patient care. As a healthcare provider, you're always on the lookout for effective tools to improve patient care and communication. Patient portal solutions have become an essential part of healthcare practices, offering a myriad of benefits to both patients and providers. In this blog post, we'll explore 7 outstanding patient portal solutions for healthcare providers that deliver on this promise, and how they can help you take your practice to new heights. Elation Health's Patient Passport Patient Passport by Elation Health is one of the top patient portal solutions for healthcare providers, enabling easy access to medical records, appointment scheduling, and secure messaging. With a user-friendly interface, patients can manage their health information and communicate with their healthcare team seamlessly. This patient portal solution also includes telemedicine capabilities, making it convenient for healthcare providers to conduct virtual appointments. NextGen Healthcare's Patient Portal NextGen Healthcare offers a comprehensive patient portal solution that integrates seamlessly with their electronic health record (EHR) system. This patient portal solution allows healthcare providers to access and manage patient information securely while offering patients the ability to view test results, schedule appointments, and request prescription refills. With a customizable interface, NextGen Healthcare's patient portal can be tailored to suit the unique needs of each practice. Athenahealth's athena Communicator As part of Athenahealth's suite of services, athena Communicator is a top-notch patient portal solution for healthcare providers. It streamlines communication between patients and providers through secure messaging, appointment scheduling, and billing management. This patient portal solution is designed to enhance patient engagement by offering personalized health content and resources based on individual health needs. CureMD's Patient Portal CureMD's patient portal solution is designed to facilitate communication between healthcare providers and their patients. This user-friendly portal enables patients to access their medical records, schedule appointments, view lab results, and request prescription refills. For healthcare providers, CureMD's patient portal offers tools for appointment management, secure messaging, and patient education resources. eClinicalWorks' healow Healow, the patient portal solution by eClinicalWorks, is a robust platform that improves patient engagement and streamlines communication between patients and healthcare providers. With features like appointment scheduling, prescription refill requests, and secure messaging, healow simplifies the patient-provider interaction. This patient portal solution also includes telemedicine capabilities, allowing healthcare providers to offer virtual care when needed. AdvancedMD's Patient Portal AdvancedMD's patient portal solution is designed to empower patients and streamline healthcare providers' workflows. This patient portal solution offers secure messaging, appointment scheduling, and access to health records. With a focus on patient engagement, AdvancedMD's patient portal includes educational resources and personalized health content to help patients better understand their health conditions. Greenway Health's Patient Portal Greenway Health's patient portal solution is a versatile tool for healthcare providers looking to improve patient engagement and communication. This patient portal solution enables patients to access their health records, request prescription refills, and schedule appointments. Additionally, Greenway Health's patient portal includes tools for healthcare providers to manage appointments, securely communicate with patients, and track patient satisfaction. These 7 outstanding patient portal solutions for healthcare providers can help enhance patient engagement, streamline communication, and improve overall patient care. By selecting the right patient portal solution for your practice, you can build stronger relationships with your patients and empower them to take control of their health. The Future of Healthcare: A Comprehensive Guide to Telemedicine Services Discover the benefits of telemedicine services and learn how they're changing the healthcare industry. From virtual consultations to remote monitoring, this guide covers everything you need to know about telemedicine. Telemedicine services have been rapidly gaining popularity in the medical practice industry, especially in the midst of the COVID-19 pandemic. With the need for social distancing, remote healthcare services have become a necessity. Telemedicine services allow patients to receive medical care from the comfort of their own homes, while also reducing the risk of exposure to the virus. In this blog post, we'll discuss everything you need to know about telemedicine services and how they're transforming the healthcare industry. What is Telemedicine? Telemedicine is the use of telecommunication and technology to provide medical care to patients remotely. It includes virtual consultations, remote monitoring, and electronic prescriptions, among other services. Telemedicine services are delivered through various digital devices such as smartphones, tablets, and computers. The Benefits of Telemedicine Services Telemedicine services have numerous benefits, including improved accessibility, cost-effectiveness, and convenience. Patients can receive medical care without having to leave their homes, which eliminates travel time and expenses. Additionally, telemedicine services can help reduce the spread of infectious diseases, such as COVID-19, by minimizing in-person interactions between patients and healthcare providers. Types of Telemedicine Services There are several types of telemedicine services available to patients, including virtual consultations, remote monitoring, and electronic prescriptions. Virtual consultations allow patients to consult with healthcare providers remotely, either through video conferencing or phone calls. Remote monitoring involves the use of digital devices to monitor a patient's health status, such as blood pressure or glucose levels. Electronic prescriptions allow healthcare providers to prescribe medications to patients digitally. Telemedicine Services for Mental Health Telemedicine services are also available for mental health care. Telepsychiatry allows patients to receive mental health treatment remotely, which is especially important during the COVID-19 pandemic. Telepsychiatry services include virtual consultations, online therapy, and support groups. Telemedicine Services and Insurance Many insurance companies now cover telemedicine services, making it more accessible to patients. Medicare and Medicaid also cover certain telemedicine services, although coverage varies by state. Patients should check with their insurance providers to determine their coverage for telemedicine services. Telemedicine services are revolutionizing the healthcare industry by improving accessibility, reducing costs, and increasing convenience for patients. With the ongoing COVID-19 pandemic, the need for remote healthcare services has become even more apparent. Whether you're a patient or a healthcare provider, understanding the benefits and types of telemedicine services available can help you make informed decisions about your healthcare. The Ultimate Guide to Outsourcing Medical Billing and Coding Services for Your Practice Discover the benefits of outsourcing medical billing and coding services for your practice. Learn how to choose the right provider and what to look for in a quality service. Improve your practice's bottom line with this comprehensive guide. As a medical professional, you understand the importance of proper medical billing and coding. However, managing these tasks in-house can be time-consuming and resource-intensive, taking time away from providing quality care to your patients. Outsourcing medical billing and coding services can help streamline your practice's operations and improve your bottom line. In this article, we'll take a closer look at what medical billing and coding services are, why outsourcing these tasks is beneficial, and how to choose the right provider for your practice. We'll also provide some tips on what to look for in a quality medical billing and coding service. What are Medical Billing and Coding Services? Medical billing and coding services are professional services that handle the administrative tasks of submitting and processing medical insurance claims on behalf of healthcare providers. These services ensure that medical bills are accurate, complete, and compliant with regulatory requirements. Why Outsource Medical Billing and Coding Services? Outsourcing medical billing and coding services can provide numerous benefits for your practice, including:

How to Choose the Right Medical Billing and Coding Provider When choosing a medical billing and coding provider, it's important to consider several factors, including: