|

Outpatient facilities have become an essential part of the healthcare industry. They offer a range of services, including diagnostic testing, surgery, and rehabilitation, to patients who don't require overnight hospitalization. As these facilities are often independent clinics or hospitals, the billing process can be complicated due to varying payer requirements and regulatory compliance rules. The billing process is a critical aspect of healthcare administration that involves several steps to ensure proper reimbursement and accurate documentation. In this article, we'll explore the billing process for outpatient facilities and provide a detailed overview of the various reimbursement systems used.

Patient Registration: The first step in the billing process is patient registration, where the patient demographic information, insurance details, and other necessary information are collected. This information is used to verify insurance coverage and establish financial responsibility. During the registration process, patients are required to provide their insurance card and identification, and the information gathered is used to create a medical record for the patient. Accurate patient registration is critical to ensure that the billing process proceeds smoothly and efficiently. Coding and Documentation: Coding and documentation are critical steps in the billing process. Medical coders and billers review the medical record to identify the procedures and services provided to the patient. The medical record includes a description of the services provided, including diagnosis, procedures, and treatments. Medical coders use various coding systems, including Current Procedural Terminology (CPT), Healthcare Common Procedure Coding System (HCPCS), and International Classification of Diseases (ICD-10-CM), to assign codes to the services provided. These codes are used to indicate the services provided, which are then used to bill the insurance company. Charge Capture: Charge capture is the process of capturing the charges associated with the services provided to the patient. The charges are based on the codes assigned to the services provided. Charge capture systems are used to automate the process of capturing charges, which reduces the likelihood of errors and improves the accuracy of the billing process. Charge capture systems can be integrated with electronic health record (EHR) systems to streamline the billing process. Claims Submission: Once the charges have been captured, the claims are submitted to the insurance company for payment. Claims can be submitted electronically or on paper, depending on the insurance company's requirements. Electronic claims submission is becoming more common due to its speed and accuracy. Claims submitted electronically are typically processed faster than paper claims. The claims submitted to the insurance company include the codes for the services provided, along with any supporting documentation. Reimbursement: The insurance company reviews the claims submitted and determines the amount of reimbursement. Reimbursement can be based on several factors, including the type of service provided, the geographic location, and the fee schedule of the insurance company. Reimbursement can also be affected by any contractual agreements between the healthcare provider and the insurance company. Once the insurance company has determined the amount of reimbursement, they will send payment to the healthcare provider. Appeals and Denials: Sometimes, claims are denied or only partially reimbursed. In these cases, the healthcare provider can appeal the decision or request additional information to support the claim. Appeals can be submitted electronically or on paper, depending on the insurance company's requirements. Denials can be caused by various factors, including coding errors, lack of medical necessity, or incomplete documentation. It's essential to identify the reason for the denial and address the issue before resubmitting the claim. Conclusion: Billing for outpatient facilities can be complex, requiring a detailed understanding of the billing process, coding systems, and reimbursement rules. The steps involved in the billing process include patient

0 Comments

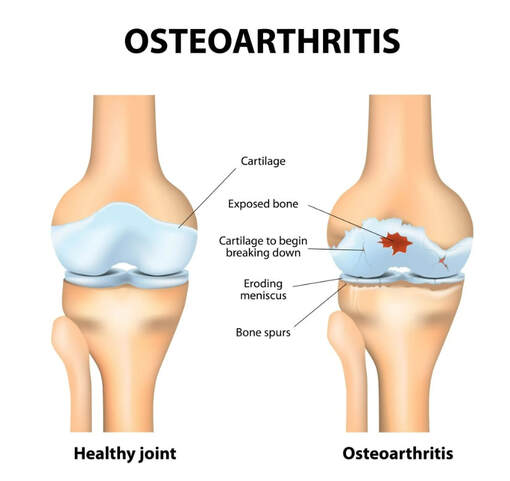

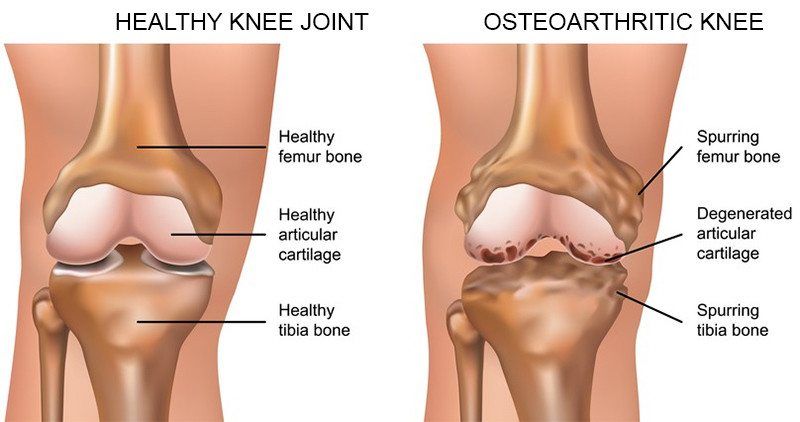

Osteoarthritis is the most common form of arthritis in the knee. It is a degenerative, "wear-and-tear" type of arthritis that occurs most often in people 50 years of age and older, although it may occur in younger people, too. In osteoarthritis, the cartilage in the knee joint gradually wears away. As the cartilage wears away, it becomes frayed and rough, and the protective space between the bones decreases. This can result in bone rubbing on bone, and produce painful bone spurs. Osteoarthritis usually develops slowly and the pain it causes worsens over time. I know it can be hard to determine if your patient's injection would need a prior authorization or precertificaton. It is always best that we verify our patients' coverage, benefits and eligibility. PRIOR AUTHORIZATION, PRECERTIFICATION & BILLING PROCESS - HYALURONAN ACID & VISCO THERAPIES FOR OSTEOARTHRITIS OF THE KNEE CPT CODES: 20605, 20606, 20610, 20611 HCPCS CODES: J7318, J7323, J7328, J3490, J7320, J7321, J7322, J7324, J7325, J7326, J7327, J7329, J7331, J7332 Let's look at a commonly published clinical policy and guideline for these visco and hyaluronan acid therapies. Pay attention to everything on this post because these can all be very helpful for your billing and in order to maximize reimbursement. Conservative Treatment: Physical therapy or pharmacotherapy/NSAIDs (e.g., non-steroidal anti-inflammatory drugs [NSAIDs], acetaminophen and/or topical capsaicin cream) Understanding Indications and Dosing: Intra-articular injections of sodium hyaluronate are proven and medically necessary when all of the following are met: 1. Diagnosis of knee osteoarthritis 2. Member has not responded adequately to conservative therapy which may include physical therapy or pharmacotherapy or injection of intra-articular steroids or member is unable to tolerate conservative therapy because of adverse side effects 3. The member reports pain which interferes with functional activities. --- ambulation, prolonged standing 4. The pain is attributed to degenerative joint disease/primary osteoarthritis of the knee. 5. There are no contraindications to the injections --- active joint infection, bleeding disorder 6. Dosing is in accordance with the US FDA approved labeling as follows. --- Durolane: Approved as a single injection --- Euflexxa: Approved for 3 injections --- Gel-One: Approved as a single injection --- Gelsyn-3: Approved for 3 injections --- GenVisc 850: Approved for 3-5 injections --- Hyalgan: Approved for 5 injections --- Hymovis: Approved for 2 injections --- Monovisc: Approved as a single injection --- Orthovisc: Approved for 3-4 injections --- Supartz: Approved for 3-5 injections --- Synojoynt: Approved for 3 injections --- Synvisc One: Approved as a single injection --- Synvisc: Approved for 3 injections --- Triluron: Approved for 3 injections --- TriVisc: Approved for 3 injections --- Visco-3: Approved for 3 injections Learn how to properly bill and report these HCPCS codes for maximized reimbursement. READ HERE! Common Criteria and Utilization Limitations: Initial Determination: --- therapy has not resulted in functional improvement after at least 3 months Reauthorization/Continuation --- At least 6 months have passed since the prior course of treatment for the respective joint Intra-articular injections of sodium hyaluronate are unproven and not medically necessary for treating any other indication due to insufficient evidence of efficacy including, but not limited to the following: ----- Hip osteoarthritis ----- Temporomandibular joint osteoarthritis ----- Temporomandibular joint disc displacement Hyaluronic acid gel preparations to improve the skin's appearance, contour and/or reduce depressions due to acne, scars, injury or wrinkles are considered cosmetic and are not covered. Contraindications: 1. Do not administer to patients with known hypersensitivity (allergy) to hyaluronate preparations or allergies to avian or avian-derived products (including eggs, feathers, or poultry). This contraindication does not apply to Orthovisc. 1. Do not administer to patients with known hypersensitivity (allergy) to gram positive bacterial proteins. This contraindication applies to Orthovisc only. 1. Do not inject sodium hyaluronate into the knees of patients with infections or skin diseases in the area of the injection site or joint. Imaging Requirements: (MRI, CT, XRAY, U/S):X-ray, CT, or MRI reports), Color Doppler ultrasound (CDUS) and synovitis scores Pain Relief: Knee Osteoarthritis (OA) --- single 6 ml IA injection of hylan G-F 20 provided better pain relief over 26 weeks Sodium Hyaluronate Product Therapy Using Preferred Products (Durolane, Euflexxa, and Gelsyn-3) >>Medical notes documenting all of the following: --- Current prescription --- diagnosis of OA of the knee --- Conservative treatment tried for at least 3 months including response --- Signs and symptoms --- Current functional limitations --- Complete report(s) of diagnostic imaging (X-ray, CT, or MRI reports) --- Previous sodium hyaluronate treatment provided including the brand name of the drug, course of treatment, and response --- Dose, frequency, interval since previous sodium hyaluronate treatment --- Physician treatment plan Medical Necessity Cross-over: M17.0 -- Bilateral primary osteoarthritis of knee M17.10 -- Unilateral primary osteoarthritis, unspecified knee M17.11 -- Unilateral primary osteoarthritis, right knee M17.12 -- Unilateral primary osteoarthritis, left knee M17.2 -- Bilateral post-traumatic osteoarthritis of knee M17.30 -- Unilateral post-traumatic osteoarthritis, unspecified knee M17.31 -- Unilateral post-traumatic osteoarthritis, right knee M17.32 -- Unilateral post-traumatic osteoarthritis, left knee M17.4 -- Other bilateral secondary osteoarthritis of knee M17.5 -- Other unilateral secondary osteoarthritis of knee M17.9 -- Osteoarthritis of knee, unspecified Learn how to Bill for HYALURONAN ACID & VISCO THERAPIES FOR OSTEOARTHRITIS OF THE KNEE References: Clinical Policies of Commercial Payers and Medicare from published in the public domains. CPT Codes are a trademark and owned by the American Medical Association. ICD-10 Code book of 2022. Categories All Archives July 2024 How to Negotiate your Physician Group or Individual Provider's Contract with the Insurance Payers  Many physician groups or even individual solo practice offices are not happy with their contracted rates or the way they are being reimbursed by the insurance payers? Is it time to negotiate? when is the best time to negotiate your contract? There is no better time than NOW! But there are important steps that you need to do before doing so. Negotiating your contract is not only by picking up the phone and calling the insurance payer's provider services department and asking them that you would like to negotiate your contracted fees. Unfortunately, it doesn't work that way! But there are important steps that you need to do before doing so. Negotiating your contract is not only by picking up the phone and calling the insurance payer's provider services department. It doesn't work that way! Here are my tips: How to Negotiate your Physician Group or Individual Provider's Contract with the Insurance Payers

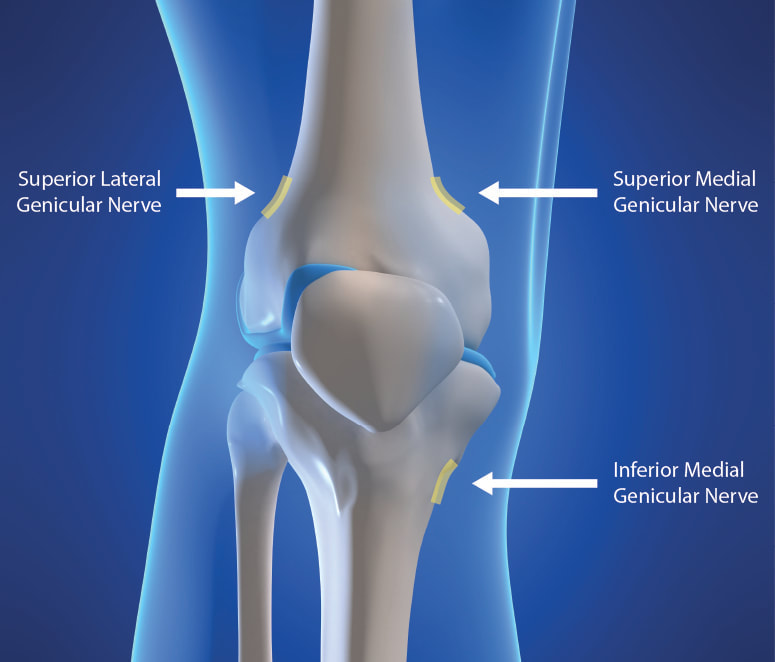

You need to present your reasoning why you think its time to negotiate your fees! All of the above, you can present it to the Insurance Payer through the Network Area Manager. Put them all together. Document everything! You can initiate the process by calling, and then by sending a formal letter of intent to renegotiate your contract rates or fee schedule. Don't forget to involve your billers and coders in this project! Let your patients leave feedback, reviews and about their experience in your practice! All these will surely help get you a better deal. It's a bit of a process but just be patient and work on it. Do you need help on how to Negotiate your Physician Group or Individual Provider's Contract with the Insurance Payers? You should contact us today!Understanding the Genicular Nerves (image below)Do you remember the struggle when we didn't have the specific code for the Genicular Nerve Knee Block and for the ablation or the RFA? Prior to January 1, 2020, we used to code them using 64450 for the Peripheral Nerve Block and the you used the 64640 for the Ablation. Not only that, you need to know the nerves that were blocked or were RFA'ed. But Effective January 1, 2020, we have now a specific code for the Genicular Nerve Knee Block and the Genicular Nerve Knee Ablation. You can read more about that change in our blog. CLICK HERE. CPT 64454 Genicular Nerve Block Injection(s), anesthetic agent(s) and/or steroid; genicular nerve branches, including imaging guidance, when performed CPT 64624 Genicular Nerve Ablation or RFA Destruction by neurolytic agent, genicular nerve branches including imaging guidance, when performed Unfortunately many of our Pain and Orthopedic Physicians are still struggling getting reimbursed for these services even though we already have these specific codes in place since 2020. And why is that? There are common issues why: 1) Their billing staff are still using the old codes CPT 64450, CPT 64640 instead of the CPT Code 64454 and 64624 for the Genicular Nerve Block and Radiofrequency Ablation; 2) What I found is that, this is considered as Investigational and Experimental based on the following guideline when being reported: Genicular nerve blocks and genicular nerve ablation are considered investigational and not medically necessary for the treatment of chronic knee pain, including but not limited to any of the following:

But I have also read that there are two CMS Contractors who covers for this procedure based on Medical Necessity. See Group 1 Diagnosis Codes Cross Over: Group 1 DX Codes:

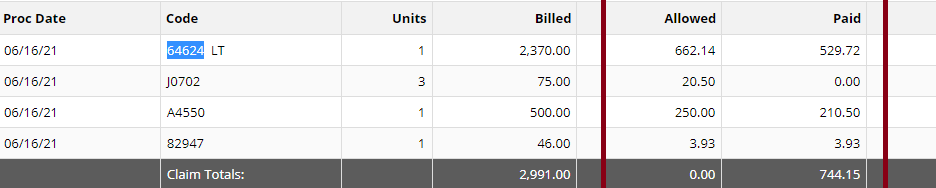

Read more about guidelines: National Government Services Inc Billing and Coding: Peripheral Nerve Blocks (A57452) First Coast Service Options, Inc Billing and Coding: Peripheral Nerve Blocks (A57788) More Guidelines from Payers which consider the procedure to be Investigational: Aetna Healthcare Anthem Blue Cross Blue Shield How do you handle Denial and Appeal for Genicular Nerve Ablation or Genicular Nerve Block? Here are my tips: Avoid the denials in the first place! by knowing your payers' guidelines; If the Provider says its Medically Necessary for the patient to receive the genicular nerve block or genicular nerve ablation, try getting a Predetermination based on Medical Necessity from your Payer! They will not allow you to submit Prior Authorization because for sure, it does not need Prior Authorization because its not a covered benefit based on their policy because the payer considers it "investigational" or "experimental"; Insist on reviewing Predetermination based on Medical Necessity instead! Already having denied claims? - pursue the claims by sending appeals, get your patient get involved with the appeals process. Be prepared with your medical documentation! How's the Patient's Pain Relief? Duration of Pain Relief? Improved ADL? - include that all in your documentation! Searched Keywords: GENICULAR NERVE BLOCK DENIAL AND APPEAL CPT BILLING CODE 64454 This is how it looks like when you get paid for Genicular Nerve Knee RFAgenicular-nerve-block-denial-and-appeal.html. Does this not look nice? HOW TO GET PAID FOR GENICULAR NERVE KNEE INJECTIONS Need help how to Appeal your claims? Contact Us today! Need help how to obtain Pre-determination before you render the Genicular Nerve Block to your patients? You should contact us today! ASC Billing for Out of Network Facility Claims When you are an out of network Ambulatory Surgery Center, it is always a struggle to get paid and have your claims get processed appropriately. It upsets the patients and much more, the ASC loses revenue. This blog post is about ASC Billing. And I am going to give you some ASC Billing Scenarios and how to tackle them. It is always wise that you have a system in place in the practice. Because I will tell you, ASC Billing is not easy. But once you understand the process, its not really too bad. These tips can be used for any practice services. Mostly I kept these in mind for our clients Pain Management Billing, Anesthesia Billing and Orthopedic Spine Billing. ASC Billing Tip: We should always remember, if the Professional Services are not Authorized, it's unlikely the ASC Facility will get paid/processed for their portion. In the perfect world of ASC, the ASC always relies on the Providers' services being verified and authorized. They have to work together, hand in hand. So here are my ASC Billing Tips for an Out of Network Facility:

NEXT; ASC Billing tip: Educate your patient about the Ambulatory Surgery Center being out of network. Because your dilemma will be, the patient will likely get the check because the payer may send it to their members! I can name some of the Insurance Payers that does this! So it is always wise to let them know checks might be directly sent to them by their insurance company. All they have to do is to endorse (sigh the back of the check) and send the check to the practice. And also don't forget to let your patient know about their out of network benefits (deductible & coinsurance). It's very important that your patients knows what to expect about the ASC being an out of network facility. ASC Billing Claims Submission tips:

So what's next for ASC Billing when claims are Denied, Rejected or Inappropriately Processed? You don't want to miss that revenue opportunity for the Out of Network Facility Fee. Out of network fees are always based on UCR (Usual and Customary Rates) based on your location. Normally I have seen up to 300% or (even more!) of Medicare Fee Schedule. At times, you will also be negotiating fees with 3rd party claims repricing companies. So be careful when negotiating your fees. You can call our office and we can guide you how to negotiate your fees. Don't be fooled. Remember, they are not the insurance company, they are just the claims repricing companies. If you don't agree with what they want to negotiate with you, send it back to the patient's primary insurance company. You can always call us if you need help in negotiating out of network fees. Contact us here. What we should do for all our UNPAID Claims:

I mean, you need to know the determination that was made on your claims and then you can take action. But moving forward, just make sure you have a team in your practice that only does Patients Access and Prior Authorization. References Source: https://www.cms.gov/Center/Provider-Type/Ambulatory-Surgical-Centers-ASC-Center Commercial Payers Public Domain Websites CPT Coding Guidelines through the American Medical Association NEW CPT Code 99072 and CPT Code 86413 DURING COVID19 PANDEMIC These 2 new CPT Codes 99072 and 86413 were published on September 8th 2020 and are effective immediately.  Let's describe these 2 new CPT Codes. CPT Code 99072 Additional supplies, materials, and clinical staff time over and above those usually included in an office visit or other non-facility service(s), when performed during a Public Health Emergency as defined by law, due to respiratory-transmitted infectious disease Take Note: This new code 99072 is reported only during a PHE (Public Health Emergency) and only for additional items required to support a safe in-person provision of evaluation, treatment, or procedural service(s). CPT Code 86413 Severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) (Coronavirus disease [COVID-19]) antibody, quantitative According to the AMA: "The first addition, CPT code 99072, was approved in response to sweeping measures adopted by medical practices and health care organizations to stem the spread of the novel coronavirus (SARS-CoV-2), while safely providing patients with access to high-quality care during in-person interactions with health care professionals. The additional supplies and clinical staff time to perform safety protocols described by code 99072 allow for the provision of evaluation, treatment or procedural services during a public health emergency in a setting where extra precautions are taken to ensure the safety of patients as well as health care professionals. The AMA/Specialty Society RVS Update Committee (RUC) worked with 50 national medical specialty societies and other organizations over the summer to collect data on the costs of maintaining safe medical offices during the public health emergency and submitted recommendations today to the Centers for Medicare and Medicaid Services to inform payment of code 99072." "The second addition, CPT code 86413, was approved in response to the development of laboratory tests that provide quantitative measurements of SARS-CoV-2 antibodies, as opposed to a qualitative assessment (positive/negative) of SAR-CoV-2 antibodies provided by laboratory tests reported by other CPT codes. By measuring antibodies to SARS-CoV-2, the tests reported by 86413 can investigate a person’s adaptive immune response to the virus and help access the effectiveness of treatments used against the infection." Must be reported only once per in-person! (read more below) Code 99072 is to be reported only once per in-person patient encounter per provider identification number (PIN), regardless of the number of services rendered at that encounter. In the instance in which the noted clinical staff activities are performed by a physician or other qualified health care professional (eg, in practice environments without clinical staff or a shortage of available staff), the activity requirements of this code would be considered as having been met; however, the time spent should not be counted in any other time-based visit or service reported during the same encounter. CPT Guidelines, Q&A from the American Medical Association: Understanding PHE or Public Health Emergency in coordination with CPT Code 99072 Question: Code 99072 is stated as being applicable “during a PHE.” What information should be used to verify when a PHE is in effect? Answer: A PHE is in effect when declared by law by the officially designated relevant public health authority(ies). Understanding Patient Encounters Type for the determination of CPT Code 99072 Question: For what type of patient encounters or services should code 99072 be reported? Answer: Code 99072 may be reported with an in-person patient encounter for an office visit or other non-facility service, in which the implemented guidelines related to mitigating the transmission of the respiratory disease for which the PHE was declared are required. Use of this code is not dependent on a specific patient diagnosis. For a list of POS codes with facility/non-facility designations that are available in the Medicare Claims Processing Manual, visit https://www.cms.gov/Medicare/Coding/place-of-service-codes. Understanding Documentation Requirements when reporting CPT Code 99072 Question: What documentation is required to report code 99072? Answer: Given that code 99072 may only be reported during a PHE, one would not report this code in conjunction with an evaluation and management (E/M) service or procedure when a PHE is not in effect. Therefore, code 99072 is reported justifiably only when health and safety conditions applicable to a PHE require the type of supplies and additional clinical staff time explained in the code descriptor. Documentation requirements may vary among third-party payers and insurers; therefore, they should be contacted to determine their specifications. How about CPT Code 99072 with CPT Code 99070? Question: May code 99072 be reported with code 99070? Answer: Yes, code 99072 may be reported with code 99070 when the requirements for both codes have been met. Note that eligibility for payment, as well as coverage policy, is determined by each individual insurer or third-party payer. Reader's QUESTION - how much are you going to be reimbursed for these 2 new codes?  Reference sources: https://www.ama-assn.org/press-center/press-releases/ama-announces-new-cpt-codes-covid-19-advancements-expand https://www.ama-assn.org/system/files/2020-09/cpt-assistant-guide-coronavirus-september-2020.pdf CPT Assistant September 2020 Special Addition CPT is a trademark and owned by the American Medical Association. Understanding Shingrix Zoster Vaccine CPT Code 90750Key points to remember in properly billing and coding for Shingrix: Keypoints to remember!

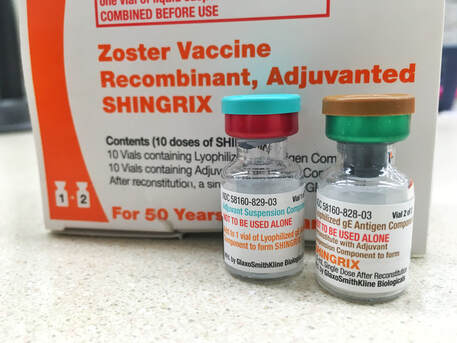

CPT Code Shingrix 90750 What's the reimbursement? CPT Code Shingrix 90750 - What's the reimbursement? I called the manufacturing company of Shingrix at GSK or Global Smith Klein and contacted their Provider Reimbursement support at Phone: 1-855-636-8291. Unfortunately they told me they don't have a national average rate on how much you can get reimbursed per unit for the Shingrix shot. Understandably because it is based on Payer's reimbursement policy. I did some research some more research and found this: From Medicaid North Carolina: ICD-10-CM diagnosis code required for billing is Z23 - Encounter for immunization. Providers must bill with CPT code: 90750 - Zoster (shingles) vaccine, (HZV), recombinant, sub-unit, adjuvanted, for intramuscular injection. One Medicaid unit of coverage is 0.5 mL. The maximum reimbursement rate per unit is $144.20. Providers must bill 11-digit National Drug Codes (NDCs) and appropriate NDC units. The NDCs are 58160-0823-11 and 58160-0819-12. The NDC units should be reported as “UN1.” You can read the complete post here - https://medicaid.ncdhhs.gov/blog/2018/02/07/billing-guidelines-zoster-vaccine-recombinant-adjuvanted-suspension-intramuscular Conclusion: It is always best that your verify your patient's benefits and eligibility for the Shingrix - Zoster Vaccine. As with Medicare, they should be under the beneficiary's Part D benefits. I hope this post helps. Understanding the 2020 CPT codes 99421, 99422, 99423 Online Digital Evaluation and Management, E/M Services for Physicians and Non-Physicians Practitioners Your Billable Codes for Digital CPT Codes are as follows: CPT Code 99421 Online digital evaluation and management service, for an established patient, for up to 7 days, cumulative time during the 7 days; 5–10 minutes CPT Code 99422 Online digital evaluation and management service, for an established patient, for up to 7 days cumulative time during the 7 days; 11– 20 minutes CPT Code 99423 Online digital evaluation and management service, for an established patient, for up to 7 days, cumulative time during the 7 days; 21 or more minutes. These codes are for use when E/M services are performed, of a type that would be done face-to-face, through a HIPAA compliant secure platform. These are for patient-initiated communications, and may be billed by clinicians who may independently bill an E/M service. They may not be used for work done by clinical staff or for clinicians who do not have E/M services in their scope of practice. Report these services once during a 7-day period, for the cumulative time. According to CPT®: “The seven-day period begins with the physician’s or other qualified health care professional’s (QHP) initial, personal review of the patient-generated inquiry. Physician’s or other QHP’s cumulative service time includes review of the initial inquiry, review of patient records or data pertinent to assessment of the patient’s problem, personal physician or other QHP interaction with clinical staff focused on the patient’s problem, development of management plans, including physician or other QHP generation of prescriptions or ordering of tests, and subsequent communication with the patient through online, telephone, email, or other digitally supported communication, which does not otherwise represent separately reported E/M service.” So how about the Clinicians who may not independently bill for evaluation and management visits? Here are your codes: For Commercial Insurance Payers, use the following codes: CPT Code 98970 Qualified nonphysician health care professional online digital evaluation and management service, for an established patient, for up to 7 days, cumulative time during the 7 days; 5-10 minutes CPT Code 98971 Qualified nonphysician health care professional online digital evaluation and management service, for an established patient, for up to 7 days, cumulative time during the 7 days; 11-20 minutes CPT Code 98972 Qualified nonphysician health care professional online digital evaluation and management service, for an established patient, for up to 7 days, cumulative time during the 7 days; 21 minutes or more Reference: Per CPT, CPT© E/M services codes 98970—98972 that says: Per CPT; “For online digital E/M services provided by a qualified nonphysician health care professional who may not report the physician or other qualified health care professional E/M services (eg, speech-language pathologists, physical therapists, occupational therapists, social workers, dietitians), see 98970, 98971, 98972).” And how about for Medicare Beneficiaries?For Medicare Beneficiaries, they have a set of HCPCS Codes that we can use (CMS does not recognize CPT Codes 98970-98972) - continue reading below HCPCS Code G2061: Qualified non-physician healthcare professional online assessment and management, for an established patient, for up to seven days, cumulative time during the 7 days; 5–10 minutes HCPCS Code G2062: Qualified non-physician healthcare professional online assessment and management service, for an established patient, for up to seven days, cumulative time during the 7 days; 11–20 minutes HCPCS Code G2063: Qualified non-physician qualified healthcare professional assessment and management service, for an established patient, for up to seven days, cumulative time during the 7 days; 21 or more minutes. References: CPT 2020, CMS Guideline and Finial Ruling. Need more help? Contact us today! (732) 982-4800The Patients Access plays a very important role in capturing and collection of patient service revenue. Patients Access and a Successful Revenue Cycle Management The Patients Access plays a very important role in capturing and collection of patient service revenue. There are 3 parts of Revenue Cycle where the Patient Access Management is very important and the Patient Access Team plays a very valuable role. 1. Pre-service Phase

2. Time of Service

3. Post-service Phase

Focusing on Customer Service and Patient Satisfaction is very important.  Customer Service and Patient Satisfaction 1. Treating patient with respect and dignity 2. Treating patient as you would want to be treated 3. Communicating in a manner the patient can easily understand 4. Value your patient's time and focus on efficiency 5. Show empathy to your patient What pieces of information do we gather:

Additional Useful information that you can also gather from the patient:

So what's next after obtaining all the necessary information? 1. Patient access team member must start confirming coverage for the patient 2. Verify if the provider is in-network or out-of-network with the patient's plan 3. Check eligibility if the patient is eligible for coverage on the date of service 4. Ask the patient if they have a secondary insurance coverage 5. Complete clarifying the benefits for services with the insurance company 6. Check the patient's copayment or any co-responsibility and if the patient has an out of pocket amount that has to be met (family or individual 7. You can ask the insurance company for specific benefits for specific services. I always suggest giving insurance company specific CPT code(s) or Diagnosis code(s) if available - document everything 8. Collect the copay at the time of service if you are contracted with the patient's insurance plan; 9. Verify if there is a deductible or coinsurance and how much have been met, you can collect them at the time of service as well 10. Make sure you be knowledgeable enough on how to answer the patient about their concern and questions about their copay or any other co-responsibility. Let's look at how the Patient Access team verifies patient who has a Medicaid Coverage: Viewing a patient's ID card alone does not ensure their Medicaid eligibility, nor does having a referral or pre-certification on file. As a member of the Patient Access team, insurance can be verified during pre-service or on the date of service. It is imperative in my opinion that the Patient Access team must verify eligibility during the MONTH that patient is scheduled to be seen or is coming for service. Because their coverage may always change. If you fail to verify eligibility, there is a very high risk of claim denial for sure. Possible scenarios? the patient may not be eligible at the time of service, or the HMO was not contracted with your practice at that time of service. Result? claim may not get paid. Resulting in lose of revenue. What happens if we did not correctly verify the patient identity?

About 40% of data used for revenue cycle management are gathered by Patients Access Teams. About 40% of data used for revenue cycle management are gathered by Patients Access Teams. Mistakes and errors will greatly affect the billing and coding process thus causing payments delay. Delayed reimbursement will significantly affect your cash flow. Patients satisfaction, prompt payments are the best results of your high quality customer service and are all based on how good your team with their communication skills. The World Health Organization or the WHO made a code for ICD-10 (not ICD-10-CM) which is the U07.2, COVID-19, virus not identified, intended to give the ability to capture suspected uncertain patients.

The reason you are getting errors in billing this code is that because U07.2 Covid-19, virus not identified has not been imported into ICD-10-CM (not yet) and its coming up as invalid. It is actually a valid code. So the guidance is to code the signs and/or symptoms and/or (for example) reporting ICD-10-CM Code Z20.828 - this code is a very code that we can report. Z20.828, Contact with and (suspected) exposure to other viral communicable diseases. I always suggest that if you have cases where you only see one code such as the U07.2 Covid-19, virus not identified , we need to go back the our providers and let them if they can give you a more appropriate codes based on signs and symptoms and as documented on their medical record. When Medicare is a Primary Insurance for the patient, the patient's part responsibility (coinsurance/deductible) normally crosses over to its secondary insurance for secondary coverage (if Medicare has the secondary insurance on file or if its set up to cross over based on the patient's coordination of benefits).

As you will notice on your Remittance advise, "Claim Information forwarded to: (insurance company here) Meaning, Medicare will forward the information to the secondary insurance. If not, try to find out if there is a secondary insurance for the patient, then you need to send the paper claim (using the HCFA 1500 form for Office/Provider/Professional Claims) to the secondary and attach a copy of the Medicare EOB (explanation of benefits). If your Practice Software can bill secondary to Medicare electronically, then that's great! Send them by electronic. If your practice management software is capable of doing this by electronic submission with attached copy of the EOB - much better!After you submit the claim to the secondary insurance, the secondary insurance EOB will then tell you if there is a copay being applied towards the patient being a secondary insurance after Medicare.You will then obviously collect that copay based on your contract with the secondary insurance company (and this is also based on the patient's contract with his/her secondary insurance). Medicare patients are mostly aware of their responsibility after the secondary insurance picks up. Bottom line here: (1) Medicare must process (not deny or reject!) the claim first being the primary; (2) Secondary insurance must then process the claim with Medicare's claim information; (3) Then, if there is a copay being applied towards the patient's responsibility -- you have to bill your patient for that copay!But honestly, I do not collect secondary insurance copay not until the secondary insurance had processed the claim (after Medicare's allowance!). WHY? because it is possible that the patient may no longer have an active policy (at the time of service) with the secondary insurance, or maybe, there is no more copay because the patient had met his/her out of pocket limit. So to streamline this issue (of which not all offices are doing it) - you must always check benefits and eligibility for your patient's primary, secondary or even tertiary insurance coverage!It may be a lot of work too, but what I do is that, when I am billing the patient a copay (from the secondary insurance's determination and per the EOB) or even for their coinsurance! I do my best to attach a copy of the EOB on the statement. That way, the patient has a copy of the said EOB and he/she will understand why I am billing him/her. How do you describe CPT 99204? Office or other outpatient visit for the evaluation and management of a new patient, which requires these 3 key components: a comprehensive examination; medical decision making of moderate complexity. Counseling and/ or coordination of care with other physicians, other qualified health care professionals, or agencies are provided consistent with the nature of the problem(s) and the patient's and/or family's needs. Usually, the presenting problem(s) are of moderate to high severity. Typically, 45 minutes are spent face-to-face with the patient and/or family. How do you report CPT 99205? - read below. Office or other outpatient visit for the evaluation and management of a new patient, which requires these 3 components: A comprehensive history; A comprehensive examination; Medical decision making of the complexity. Counseling and/or coordination of care with other physicians, other qualified health care professionals, or agencies are provided consistent with the nature of the problem(s) and the patient's and/or family needs. Usually, the presenting problems(s) are of moderate to high severity. Typically, 60 minutes are spent face-to-face with the patient and/or family CPT 99204 and or CPT 99205 Key Points:

Modifier 58 Staged or Related Procedure or Service During Postoperative Period by Same Physician  Guideline: The same physician planned, at time of original surgery/procedure, a return trip to operating or procedure room within 10 or 90 day post op days WHEN IT IS APPROPRIATE:

Physicians in same specialty, same group are to bill and are reimbursed as a single physician Key to Remember! Use modifier 78 (not 58!) for treatment problems unplanned requiring return trip to operating room If hardware removed in unplanned surgery return for a complication, (e.g. infection of the wound site or rejection of the hardware itself), modifier 78 appropriate It is NOT APPROPRIATE WHEN:

References:

CMS Medicare Website Coding Books Payers Websites UNDERSTANDING HOW TO USE MODIFIER 79  How to Use Modifier 79 How to Use Modifier 79 Per the Current Procedure Terminology® (CPT®) manual, the descriptor of modifier 79 is: • "Unrelated procedure or service by the same physician during the postoperative period." As indicated, this modifier is used to bill an unrelated procedure or service performed by the same physician during the postoperative period of a previous surgical procedure. When a patient has surgery performed, there is a postoperative period -- a period after the surgery has been performed when additional surgical care related to the initial surgery is considered already covered (and paid for) by the allowance provided for the initial surgery. The postoperative period can be zero or 10 days (minor surgical procedure) or 90 days (major surgical procedure). (Note that some surgeries are considered so minor that they have a zero day postoperative period, usually a very quick outpatient procedure.) Modifier 79 should be used when a surgical procedure is:

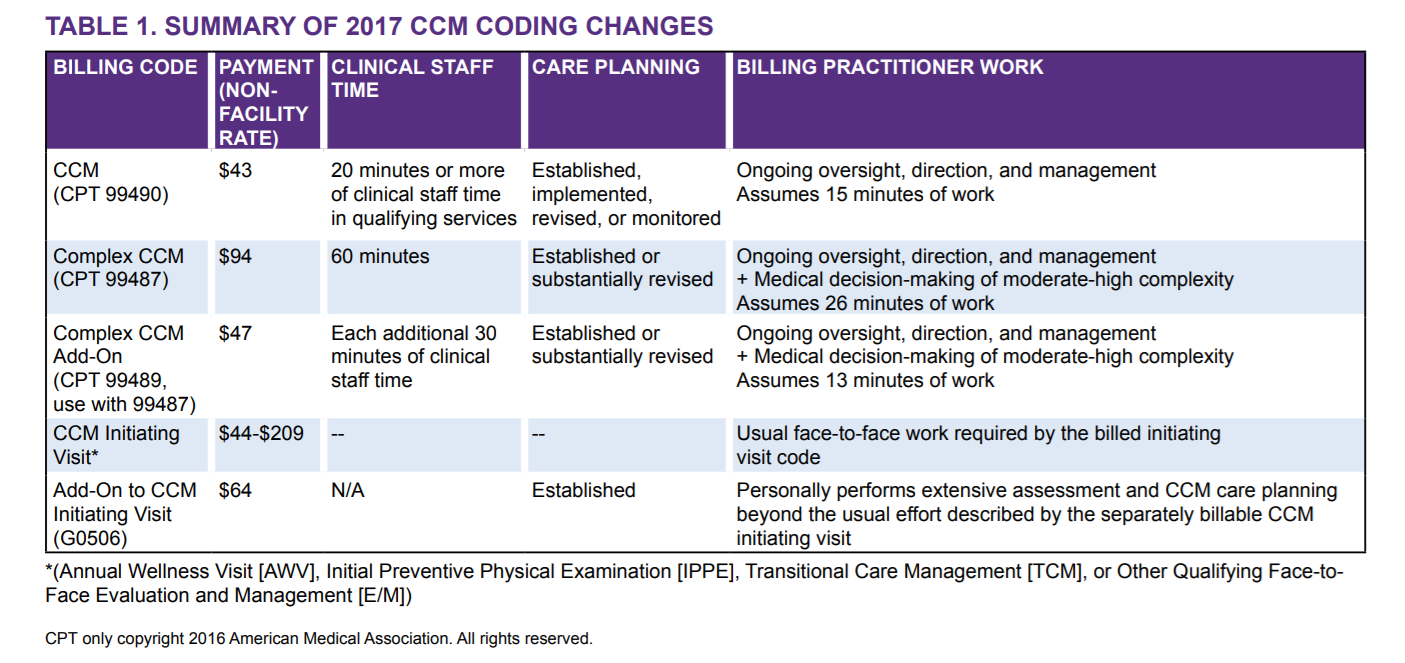

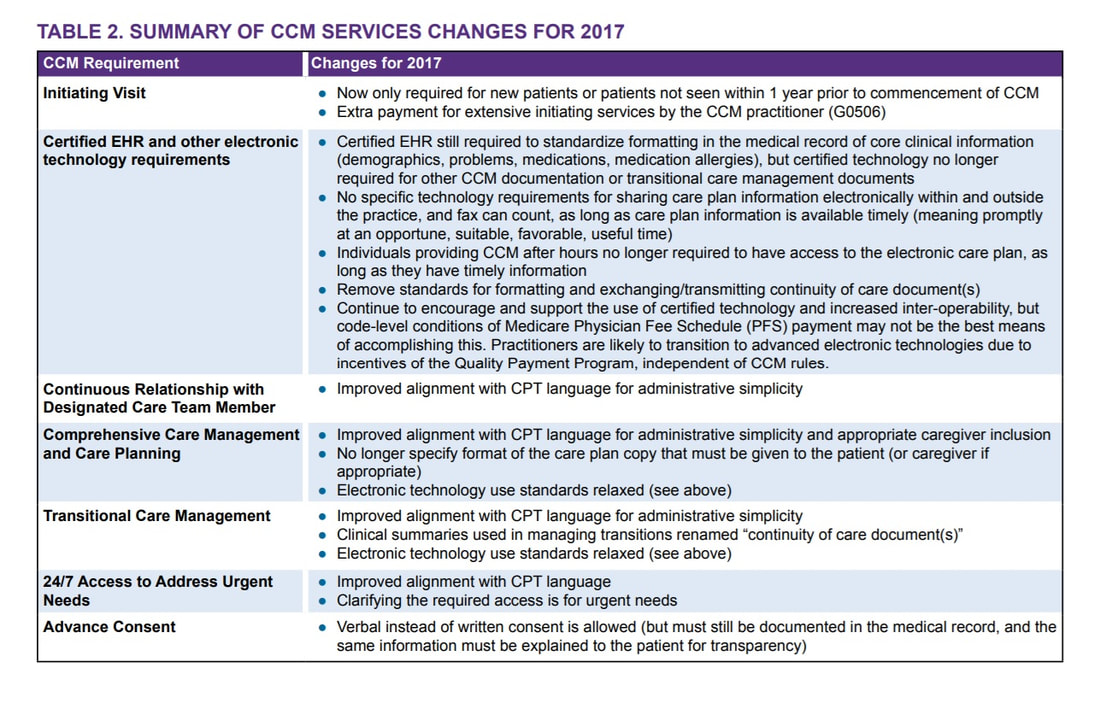

REMEMBER! When the 79 modifier is used, a new postoperative period for the second surgical procedure begins. Additionally, the remainder of the postoperative period of the original surgery is still applicable. References: Medicare CMS Website American Medical Association CPT Coding Books Payers Websites How to Bill Chronic Care Management 99490 and Complex CCM 99487, 99489  Chronic Care Management Services and the New Changes for 2017 CMS Medicare recognizes the Chronic Care Management (CCM) as a critical component of primary care services that contributes to better health and care for individuals. So in 2015, Medicare began paying separately under the Medicare Physician Fee Schedule for CCM services furnished to Medicare patients with multiple chronic conditions. Beginning January 1, 2017, the CCM codes are: Code 99490 Chronic care management services, at least 20 minutes of clinical staff time directed by a physician or other qualified health care professional, per calendar month, with the following required elements:

Keys to Remember: Let’s try to describe what CCM is or Chronic Care Management Services. These are services rendered by a Physician or Non-Physician Practitioners such as Nurse Practitioners, Physician Assistants, Clinical Nurse Specialist, Certified Nurse-Midwife and the CLINICAL Staff --- per month, for patients with two or more chronic medical conditions expected to last at least 12 months or until the death of the patient, and that place the patient at significant risk of death, acute exacerbation/decompensation, or functional decline. Take note that ONLY (1) One Practitioner can report and bill for Chronic Care Management per month. The included services are: ○ Access and use of a Certified Electronic Health Record (EHR) ○ Continuity of Care with Designated Care Team Member ○ Comprehensive Care Management and Care Planning ○ Transitional Care Management ○ Coordination with Home and Community-Based Clinical Service Providers ○ 24/7 Access to Address Urgent Needs ○ Enhanced Communication (email, and telephone for example) ○ Advance Consent CCM Changes in 2017 are the following:

There is a more complex care and we describe it as Complex Chronic Care Management services; Here are your two new codes for the Complex CCM - Complex Chronic Care Management services: CPT 99487 Complex chronic care management services, with the following required elements: ● Multiple (two or more) chronic conditions expected to last at least 12 months, or until the death of the patient; ● Chronic conditions place the patient at significant risk of death, acute exacerbation/ decompensation, or functional decline; ● Establishment or substantial revision of a comprehensive care plan ● Moderate or high complexity medical decision making ● 60 minutes of clinical staff time directed by a physician or other qualified health care professional, per calendar month (Novitas Part B NJ North $102.36) CPT +99489 --- (this is an add-code and cannot be billed by itself!) Each additional 30 minutes of clinical staff time directed by a physician or other qualified health care professional, per calendar month (List separately in addition to code for primary procedure) Complex CCM services of less than 60 minutes in duration, in a calendar month, are not reported separately(Novitas Part B NJ North $50.98) Supervision The CCM codes (CPT 99487, 99489, and 99490) are assigned general supervision under the Medicare PFS. General supervision means when the service is not personally performed by the billing practitioner, it is performed under his or her overall direction and control although his or her physical presence is not required. Patient Eligibility Patients with multiple (two or more) chronic conditions expected to last at least 12 months or until the death of the patient, and that place the patient at signifcant risk of death, acute exacerbation/decompensation, or functional decline are eligible for CCM services. ● Billing practitioners may consider identifying patients who require CCM services using criteria suggested in CPT guidance (such as number of illnesses, number of medications or repeat admissions or emergency department visits) or the profile of typical patients in the CPT prefatory language. ● There is a need to reduce geographic and racial/ethnic disparities in health through provision of CCM services. Table 2 provides a number of resources for identifying and engaging subpopulations to help reduce these disparities. The billing practitioner cannot report both complex and regular (non-complex) CCM for a given patient for a given calendar month. In other words, a given patient receives either complex or non-complex CCM during a given service period, not both. Examples of chronic conditions include, but are not limited to, the following: ● Alzheimer’s disease and related dementia ● Arthritis (osteoarthritis and rheumatoid) ● Asthma ● Atrial fbrillation ● Autism spectrum disorders ● Cancer ● Cardiovascular Disease ● Chronic Obstructive Pulmonary Disease ● Depression ● Diabetes ● Hypertension ● Infectious diseases such as HIV/AIDS Initiating Visit For new patients or patients not seen within one year prior to the commencement of CCM, Medicare requires initiation of CCM services during a face-to-face visit with the billing practitioner (an Annual Wellness Visit [AWV] or Initial Preventive Physical Exam [IPPE], or other face-to-face visit with the billing practitioner). This initiating visit is not part of the CCM service and is separately billed. Practitioners who furnish a CCM initiating visit and personally perform extensive assessment and CCM care planning outside of the usual effort described by the initiating visit code may also bill HCPCS code G0506 (Comprehensive assessment of and care planning by the physician or other qualifed health care professional for patients requiring chronic care management services [billed separately from monthly care management services] [Add-on code, list separately in addition to primary service]). G0506 is reportable once per CCM billing practitioner, in conjunction with CCM initiation. Patient Consent Obtaining advance consent for CCM services ensures the patient is engaged and aware of applicable cost sharing. It may also help prevent duplicative practitioner billing. A practitioner must obtain patient consent before furnishing or billing CCM. Consent may be verbal or written but must be documented in the medical record, and includes informing them about: ● The availability of CCM services and applicable cost-sharing ● That only one practitioner can furnish and be paid for CCM services during a calendar month ● The right to stop CCM services at any time (effective at the end of the calendar month) Insurance Payment Allowed 100% of Charged Amount is not something to celebrate! I asked some of my readers about how they will feel if their claims has an allowed amount that is at 100% of the charged amount, wow! So, meaning, when you bill for $2000.00 and the insurance made their determination at 100% of your charges… you bill $2,000, they allowed $2,000 – would you be happy?

Honestly, if I see EOB like this, I will be very very nervous! Your provider could have been paid more than the practice submitted charges, isn’t it? Interestingly, most of my readers said they’ll be happy if they were paid at 100% of their charges… now, would you? What if the allowed amount could have been $2,500? – how much is the difference? Yep, $500! How can the payer allow $2,500 if you have only submitted a charged amount of $2,000?! Make sense? Ok, now, here’s the deal! — if you got paid at 100% based on your charged amount you should find out about your fee schedule or contracted rate or what is usual and customary if you are out of network provider. Make sure you know you are not under-charging the insurance payer. But what if you have realized that you did under-charge the insurance payer? what will you do? can you recover the money that you could have been paid for? The answer is YES! you can recover that money! Now, don’t wait too long! Take action immediately! Based on my experience, you can go back as far as 3 years from the date the claims were paid. I haven’t tried more than 3 years of claim to recover due to undercharges! After all, just like the insurance payer, they can always go back as far as more than 3 years I think to recover overpayments. Or depending on where state you are located. Pay attention on your EOBs! I think that’s the key. As soon as you discover there is an undercharging and you were paid 100% on your charged amount. Pick up the phone and call that insurance payer immediately. Connect with us today, we will show you better strategies on how to run an effective revenue cycle management! Why the CPT UNLISTED CODES IMPORTANT? Here are our Unlisted Service or Procedure Codes A service encounter or surgical procedure may be provided that is not listed in this edition of the CPT code book. When reporting such a encounter or service, the appropriate “Unlisted Procedure” code may be used to indicate the service, identifying it by “Special Report” as discussed in the section below. The “Unlisted Procedures” and accompanying codes for Surgery are as follows: 15999 Unlisted procedure, excision pressure ulcer 17999 Unlisted procedure, skin, mucous membrane and subcutaneous tissue 19499 Unlisted procedure, breast 20999 Unlisted procedure, musculoskeletal system, general 21089 Unlisted maxillofacial prosthetic procedure 21299 Unlisted craniofacial and maxillofacial procedure 21499 Unlisted musculoskeletal procedure, head 21899 Unlisted procedure, neck or thorax 22899 Unlisted procedure, spine 22999 Unlisted procedure, abdomen, musculoskeletal system 23929 Unlisted procedure, shoulder 24999 Unlisted procedure, humerus or elbow 25999 Unlisted procedure, forearm or wrist 26989 Unlisted procedure, hands or fingers 27299 Unlisted procedure, pelvis or hip joint 27599 Unlisted procedure, femur or knee 27899 Unlisted procedure, leg or ankle 28899 Unlisted procedure, foot or toes 29799 Unlisted procedure, casting or strapping 29999 Unlisted procedure, arthroscopy 30999 Unlisted procedure, nose 31299 Unlisted procedure, accessory sinuses 31599 Unlisted procedure, larynx 31899 Unlisted procedure, trachea, bronchi 32999 Unlisted procedure, lungs and pleura 33999 Unlisted procedure, cardiac surgery 36299 Unlisted procedure, vascular injection 37501 Unlisted vascular endoscopy procedure 37799 Unlisted procedure, vascular surgery 38129 Unlisted laparoscopy procedure, spleen 38589 Unlisted laparoscopy procedure, lymphatic system 38999 Unlisted procedure, hemic or lymphatic system 39499 Unlisted procedure, mediastinum 39599 Unlisted procedure, diaphragm 40799 Unlisted procedure, lips 40899 Unlisted procedure, vestibule of mouth 41599 Unlisted procedure, tongue, floor of mouth 41899 Unlisted procedure, dentoalveolar structures 42299 Unlisted procedure, palate, uvula 42699 Unlisted procedure, salivary glands or ducts 42999 Unlisted procedure, pharynx, adenoids, or tonsils 43289 Unlisted laparoscopy procedure, esophagus 43499 Unlisted procedure, esophagus 43659 Unlisted laparoscopy procedure, stomach 43999 Unlisted procedure, stomach 44238 Unlisted laparoscopy procedure, intestine (except rectum) 44799 Unlisted procedure, intestine 44899 Unlisted procedure, Meckel’s diverticulum and the mesentery 44979 Unlisted laparoscopy procedure, appendix 45399 Unlisted procedure, colon 45499 Unlisted laparoscopy procedure, rectum 45999 Unlisted procedure, rectum 46999 Unlisted procedure, anus 47379 Unlisted laparoscopic procedure, liver 47399 Unlisted procedure, liver 47579 Unlisted laparoscopy procedure, biliary tract 47999 Unlisted procedure, biliary tract 48999 Unlisted procedure, pancreas 49329 Unlisted laparoscopy procedure, abdomen, peritoneum and omentum 49659 Unlisted laparoscopy procedure, hernioplasty, herniorrhaphy, herniotomy 49999 Unlisted procedure, abdomen, peritoneum and omentum 50549 Unlisted laparoscopy procedure, renal 50949 Unlisted laparoscopy procedure, ureter 51999 Unlisted laparoscopy procedure, bladder 53899 Unlisted procedure, urinary system 54699 Unlisted laparoscopy procedure, testis 55559 Unlisted laparoscopy procedure, spermatic cord 55899 Unlisted procedure, male genital system 58578 Unlisted laparoscopy procedure, uterus 58579 Unlisted hysteroscopy procedure, uterus 58679 Unlisted laparoscopy procedure, oviduct, ovary 58999 Unlisted procedure, female genital system (nonobstetrical) 59897 Unlisted fetal invasive procedure, including ultrasound guidance, when performed 59898 Unlisted laparoscopy procedure, maternity care and delivery 59899 Unlisted procedure, maternity care and delivery 60659 Unlisted laparoscopy procedure, endocrine system 60699 Unlisted procedure, endocrine system 64999 Unlisted procedure, nervous system 66999 Unlisted procedure, anterior segment of eye 67299 Unlisted procedure, posterior segment 67399 Unlisted procedure, ocular muscle 67599 Unlisted procedure, orbit 67999 Unlisted procedure, eyelids 68399 Unlisted procedure, conjunctiva 68899 Unlisted procedure, lacrimal system 69399 Unlisted procedure, external ear 69799 Unlisted procedure, middle ear 69949 Unlisted procedure, inner ear 69979 Unlisted procedure, temporal bone, middle fossa approach When you bill for unlisted code, I always recommend to submit medical documentation. Most of the payers may require additional information. So make sure you submit your documentation and operative report as well. This way, we can avoid payment delays.

Can you bill a Medicare Patient for Missed Appointment or No-Show? When patients missed their appointments, it does cost you your time and your staff. In this article, you are wondering if you can bill Medicare when their beneficiaries missed and appointment or has no-show. Below you will find clarifications. According to Chapter 1, section 30.3.13 of the Medicare Claims Processing Manual, which is attached to CR5613, CMS policy allows physicians, providers, and suppliers to charge Medicare beneficiaries for missed appointments, provided that they do not discriminate against Medicare beneficiaries but also charge nonMedicare patients for missed appointments and the charges for Medicare and non-Medicare patient are the same. The charge for a missed appointment is not a charge for a service itself (to which the assignment and limiting charge provisions apply), but rather is a charge for a missed business opportunity. Therefore, if a physician's or supplier's missed appointment policy applies equally to all patients (Medicare and non-Medicare), then the Medicare law and regulations do not preclude the physician or supplier from charging the Medicare patient directly. The other key points of CR5613 are:

According to Medicare guideline; "make certain that your billing staff is aware that you may bill the beneficiary directly, that Medicare itself does not make any payments for missed appointments, and that Medicare should not be billed for these charges". "The Centers for Medicare & Medicaid Services (CMS) policy is to allow physicians and suppliers to charge Medicare beneficiaries for missed appointments. However, Medicare itself does not pay for missed appointments, so such charges should not be billed to Medicare." "Providers may not charge ONLY Medicare beneficiaries for missed appointments; they must also charge non-Medicare patients. The amount the physician/supplier charges Medicare beneficiaries for missed appointments must be the same as the amount that they charge non-Medicare patients." Source: MLN: MM5613 Related Change Request Number: 5613 Need our professional consulting advise to run a more efficient Revenue Cycle Management? - call and talk to us at 609-481-3494

10 Common Reasons Claims Gets Denied and Rejected (1) Incorrect demographic information (insurance ID , date of birth, even the gender!)

Always scan a copy of your patient's primary and secondary insurance card. Make sure to get a copy of their new card (if there is a change) (2) Patient's non-coverage or terminated coverage at the time of service may also be the reason of denial. That is why, it is very important that you check on your patient's benefits and eligibility before seeing the patient (unfortunately, I have seen practices who does not check benefits and eligibility on their patients so they end up being not paid for the service they have rendered for the patient (3) Coding Issues (requires 5th digit, outdated codes)--- be careful also with your secondary/additional codes! Claims may be denied even if the problem was just because of the secondary codes!Again as I previously pointed out with my other articles on tracking your claims, with this problem, discuss solving the coding error rather than how much you want to get reimbursed. Most of the insurance companies will help you with codes (in fairness!!) and they also inform you on outdated codes, or codes that requires a 5th digit. You can also clarify by asking them more information on their reimbursement and utilization guidelines (4) Improper use of modifiers (be careful with bilateral procedures!, modifiers for professional and technical component, modifiers for multiple procedures, postoperative period, etc.) (5) No precertification or preauthorization obtained. It is so hard to file an appeal when the claim or service was non-precertified. Avoid this from happening! So be careful with your Surgical Procedures, Therapy Services and DME Services. (6) No referral on file. HMOs or the Managed Care normally requires a referral! (remember that!). Most Therapy Services would require a an order or script from the referring provider. Make sure the referring provider's NPI appears on Box 17 on your HCFA 1500 Claim Form (7) The patient has other primary insurance, the patient turn out to be a Workman's Comp case or an MVA case. Call our office, we can give you an example of our template of benefits eligibility verification. Remember, WC/MVA cases services are normally always require Prior Auth so make sure you have the claim information, connect with the Adjustor and the Nurse Case Manager (8) Claim requires documentation, require additional notes to support medical necessity. A well documented medical records is a good practice! (9) Claim requires referring physician's information (very common for Therapy Services and DME Billing requirements) (10) Untimely filing. So how can you prove that you did submit the claims in a timely manner? When unfortunately, most of the insurances does not accept your billing records on your practice management software that shows that date(s) you billed the insurance! They want a receipt from your electronic receipt or for postal mail, obviously they want a receipt too! a tracking number maybe? certified letter receipt? If you are submitting claims by electronic, make sure you generate transmission reports/receipts. Your reports must read "accepted" or "in process" and not "rejected". If you are sending claims by paper or postal mail, it is a good idea to send your claims as certified mail with tracking number, keep your transmission receipts! Need our professional consulting advise to run a more efficient Revenue Cycle Management? - call and talk to us at 609-481-3494 |

ABOUT THE AUTHOR:

Ms. Pinky Maniri-Pescasio is the Founder of GoHealthcare Consulting. She is a National Speaker on Practice Reimbursement and a Physician Advocate. She has served the Medical Practice Industry for more than 25 years as a Professional Medical Practice Consultant. search hereArchives

July 2024

Categories

All

BROWSE HERE

All

|

- About

- Leadership

- Contact Us

- Testimonials

- READ OUR BLOG

-

Let's Meet in Person

- 2023 ORTHOPEDIC VALUE BASED CARE CONFERENCE

- 2023 AAOS Annual Meeting of the American Academy of Orthopaedic Surgeons

- 2023 ASIPP 25th Annual Meeting of the American Society of Interventional Pain Management

- 2023 Becker's 20th Annual Spine, Orthopedic & Pain Management-Driven ASC Conference

- 2023 FSIPP Annual Conference by FSIPP FSPMR Florida Society Of Interventional Pain Physicians

- 2023 New York and New Jersey Pain Medicine Symposium

- Frequently Asked Questions and Answers - GoHealthcare Practice Solutions

- Readers Questions

Photos from shixart1985 (CC BY 2.0), www.ilmicrofono.it, shixart1985

RSS Feed

RSS Feed