|

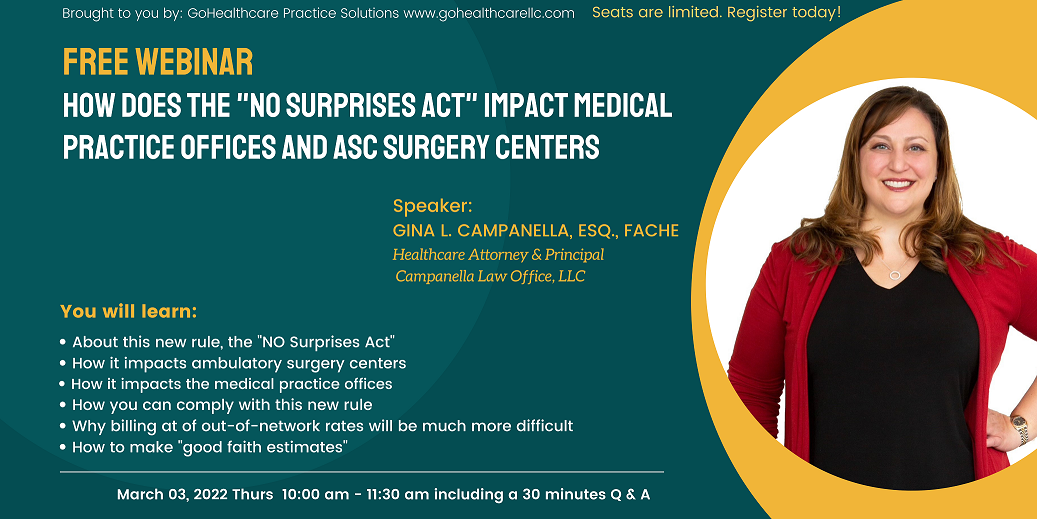

As a result of the 2021 Consolidated Appropriations Act, several No Surprises Billing Act regulations will go into effect on Jan. 1, 2022 for providers, facilities and air ambulance services. The No Surprises Billing Act regulations came into play to protect patients from surprise medical bills. These regulations will affect providers, facilities, and air ambulance services that receive payment from a commercial insurer for providing emergency or non-emergency care to a beneficiary in a health care emergency situation. Providers must comply with the regulations if they want to continue working under these insurance plans. Providers, facilities, and air ambulance operators can avoid falling out of compliance by getting their billing processes ready before Jan. 1, 2022. Here is what you need to know about the 2021 Consolidated Appropriations Act: What are "No Surprises" claims? The term "No Surprises Billing" has been around for more than 20 years, but the full act was passed in 2021. This act requires providers to disclose medical billing information to patients prior to rendering services if they receive payment from commercial insurers for providing emergency or non-emergency care. Providers must inform patients about out-of-pocket costs and may not balance bill them for covered charges after receiving payment from insurance companies. Covered entities include: Health care providers (physicians, hospitals, imaging centers, therapists) Laboratories Air ambulance services (ground or air) What types of claims are affected by the Act? The regulations affect all "No Surprises" claims—including claims for emergency medical care, inpatient hospital admission, and outpatient treatments. However, non-covered medical expenses like cosmetic surgery or dental work are not affected by the regulations. What is considered an "emergency" under the regulations? The regulations protect patients receiving emergency medical care, including surgeries and treatment for acute episodes of illness/injury which pose a threat to life or limb. Emergency medical care may also include transportation to the hospital if it is recommended by EMTs. Patients will be protected from any out-of-network charges exceeding $1,000 incurred during actual emergency services only (to include EMS services). It does not apply to non-covered services like cosmetic surgery or dental work. What billing statements need to be sent before Jan. 1, 2022? Providers can avoid falling out of compliance by sending one of three disclosures prior to rendering services: An advance written notice that informs patients of potential out-of-pocket costs and discloses all the providers who will participate in their care. The notice must include a list of all other providers involved in patient's care, an estimated dollar amount for each non-covered service and the dollar amount the patient will be responsible to pay for each provider. Providers can describe these amounts as "your estimated responsibility" if they don't have exact figures at the time of the disclosure, but it must include a disclaimer statement if no actual estimate is available. A separate written notice informing patients that they may be liable for more than $1,000 if insurance does not cover any or part of their medical bill that needs to be provided before services are rendered. The patient cannot be billed until the total cost has been disclosed to them. Providers must inform patients of their right to refuse services if they anticipate an out-of-network provider will be involved in care and that a bill may result from non-covered providers. In this case, the patient is no longer protected under the No Surprises Act for any charges incurred above $1,000 as a result of non-covered services from those providers. Patients must also receive a final written estimate from every participating provider before being transferred or discharged from a facility/hospital to have "reasonable assurance" all fees have been disclosed prior to rendering services, according to CMS guidelines . What can happen if you don't comply with these regulations? State agencies overseeing licensure can assess penalties of $1,000 for the first offense and up to $10,000 per subsequent infraction. Civil money penalties of $5,000 or up to $50,000 per incident may be assessed against individual physicians and other practitioners who violate the patient disclosure requirements. Physicians found to abuse their patients rights under this Act could face disciplinary action from state medical boards. What's the bottom line? CMS estimates that 56 million consumers receive surprise medical bills each year. The No Surprises Act is intended to ease some of these financial burdens by requiring all providers—including hospitals and out-of-network doctors—to provide upfront billing information about potential charges so patients aren't in a position where they must make difficult choices between paying for lifesaving treatments or putting food on the table. The No Surprises Act was signed into law in December 2016 and takes effect January 1, 2022. These regulations ease some of the burden that surprise medical bills place on patients when they receive care from non-contracted providers like ER doctors or specialists who don't accept insurance—even when the services are viewed as emergencies by insurers. Under these new regulations, patients will be protected under what's known as "surprise billing" protections for covered medical expenses like emergency procedures performed at in-network hospitals or ambulances operated by contracted transportation companies. The No Surprises Act also requires that physicians disclose all participating providers before rendering any service in an effort to allow patients to make informed decisions about their clinical needs or insurance coverage. At this time, CMS does not consider CT scans to fall under these regulations unless performed in an emergency. No surprise it's a tough time to be working in health care... CMS Issues Proposed Rule for No-Surprises Billing Protections -- While many of the changes are good news, other aspects are frustrating both providers and patients. Patients will be protected under what's known as "surprise billing" protections for covered medical expenses like emergency procedures performed at in-network hospitals or ambulances operated by contracted transportation companies. The No Surprises Act also requires that physicians disclose all participating providers before rendering any service in an effort to allow patients to make informed decisions about their clinical needs or insurance coverage. At this time, CMS does not consider CT scans to fall under these regulations unless performed in an emergency. CMS Issues Proposed Rule for No-Surprises Billing Protections -- While many of the changes are good news, other aspects are frustrating both providers and patients. Under these new regulations, patients will be protected under what's known as "surprise billing" protections for covered medical expenses like emergency procedures performed at in-network hospitals or ambulances operated by contracted transportation companies. The No Surprises Act also requires that physicians disclose all participating providers before rendering any service in an effort to allow patients to make informed decisions about their clinical needs or insurance coverage. At this time, CMS does not consider CT scans to fall under these regulations unless performed in an emergency." And to make it even better, the "No Surprises" Act takes effect January 1st... Although not entirely unexpected (the No Surprises Billing Act was part of the 2016 Consolidated Appropriations Act), CMS has proposed regulations that go into effect Jan. 1, 2022 that provide protections for insured patients who receive care from out-of-network physicians and other providers involved in surprise billing practices. The American College of Emergency Physicians (ACEP) issued a statement saying it is pleased with these rules as they recognize emergency care as necessary medical care requiring treatment by any physician willing to render such service. ACEP also said it continues to review specific provisions within CMS's proposed rule and will submit detailed comments pointing out language that needs clarification or revising. CMS has proposed that physicians and hospitals must: - provide written notice to patients of the right to receive emergency services from an out-of-network provider without balance billing, and must disclose all providers within the same hospital system who will be involved in a patient's care; - if they do not have direct access to this information, inform them of their right to receive such written notice directly from any physician or other health care provider rendering such services as long as such notice is provided before receiving medical treatment; and - make reasonable efforts to arrange emergency services with an out-of-network provider who will agree, prior to providing such service, either: (i) accept the insurer's negotiated rate as payment in full for such emergency services; or (ii) to bill the patient for any balance above the insurer's payment. The American College of Emergency Physicians (ACEP) issued a statement saying it is pleased with these rules as they recognize emergency care as necessary medical care requiring treatment by any physician willing to render such service. ACEP also said it continues to review specific provisions within CMS's proposed rule and will submit detailed comments pointing out language that needs clarification or revising. CMS Issues Proposed Rule for No-Surprises Billing Protections -- While many of the changes are good news, other aspects are frustrating both providers and patients.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

ABOUT THE AUTHOR:

Ms. Pinky Maniri-Pescasio is the Founder of GoHealthcare Consulting. She is a National Speaker on Practice Reimbursement and a Physician Advocate. She has served the Medical Practice Industry for more than 25 years as a Professional Medical Practice Consultant. search hereArchives

July 2024

Categories

All

BROWSE HERE

All

|

- About

- Leadership

- Contact Us

- Testimonials

- READ OUR BLOG

-

Let's Meet in Person

- 2023 ORTHOPEDIC VALUE BASED CARE CONFERENCE

- 2023 AAOS Annual Meeting of the American Academy of Orthopaedic Surgeons

- 2023 ASIPP 25th Annual Meeting of the American Society of Interventional Pain Management

- 2023 Becker's 20th Annual Spine, Orthopedic & Pain Management-Driven ASC Conference

- 2023 FSIPP Annual Conference by FSIPP FSPMR Florida Society Of Interventional Pain Physicians

- 2023 New York and New Jersey Pain Medicine Symposium

- Frequently Asked Questions and Answers - GoHealthcare Practice Solutions

- Readers Questions

Photos from shixart1985 (CC BY 2.0), www.ilmicrofono.it, shixart1985

RSS Feed

RSS Feed